Understand your Venture Capital Term Sheet! 📜

Key term sheet definitions you need to know before you start negotiating with a VC fund!

Make sure you understand these terms before you get too excited about your next term sheet 😉!

1. Money Raised 💰

Just like the term says, it is the size of the round, not necessarily how much the VC fund is willing to invest. It’s the amount the VC fund is comfortable with.

2. Pre-Money Valuation

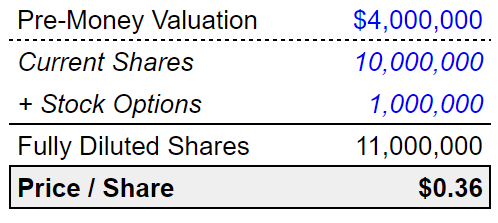

The pre-money valuation determines the value of your shares for this current round.

The pre-money valuation amount divided by the existing number of shares (+ stock options) will give the price of shares at which new investors will buy. In this case, the pre-money is $4M. There are 10M shares and 1M stock options. As a result, the investor is making an offer to invest at 36c per share.

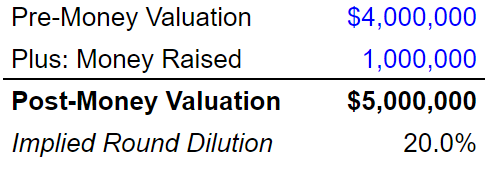

3. Post-Money Valuation

The post-money valuation is the pre-money valuation plus the amount raised in this round. It gives the entrepreneur the total value of the company post-round and the implied dilution.

⚠️ Point To Negotiate:

- Your dilution. Earlier rounds start at 10%. More mature rounds can be closer to 20%/25%.

4. Preferred vs Ordinary Shares

From pre-seed to growth, the two most common types of shares issues are ordinary and preferred.

a. Ordinary: This class of shares gives shareholders equal rights at liquidity, i.e. it does not matter at what price anyone bought their shares, they will all sell at the same price. This is common for pre-seed fundraising and much less for the subsequent rounds.

b. Preferred: Preferred shares give reimbursement priority to its holders. In case of liquidity, the preferred will be reimbursed first. This is the most common type of shares for seed to growth rounds. Read definition 5 to understand the two mechanisms.

⚠️ Point To Negotiate:

- Liquid. pref multiple (1x, 2x, or more?)

5. Participating (😬) or Non-Participating Preferred

This is where it gets tricky. Make sure you understand this part, especially if the investor is offering you participating! Let’s start with the latter:

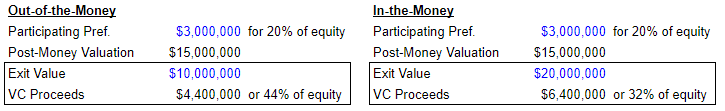

a. Participating: In a participating preferred, the investor first gets his investment back, then the remainder is split according to the cap table ownership of all parties. See below examples for out-of-the-money and in-the-money:

In both cases, the investors purchased the rights for 20% of the equity but at exit earned a significantly higher amount of the equity. He’s double-dipping.

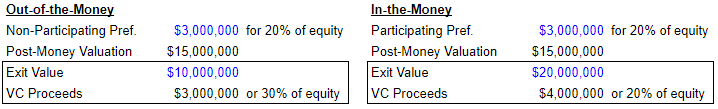

b. Non-Participating: In a non-participating preferred, the investor is simply looking to earn back its investment in case the company is sold below the investor’s share price. If the value is above, the preferred are purely symbolic.

As you can see on the left, in case the company is sold $10M and the investor makes his money back first. Other shareholders get the remaining $7M. On the right, the exit value is above last round’s. The investor purchased 20% of the equity and at exit earns 20% of the equity. Fair and square!

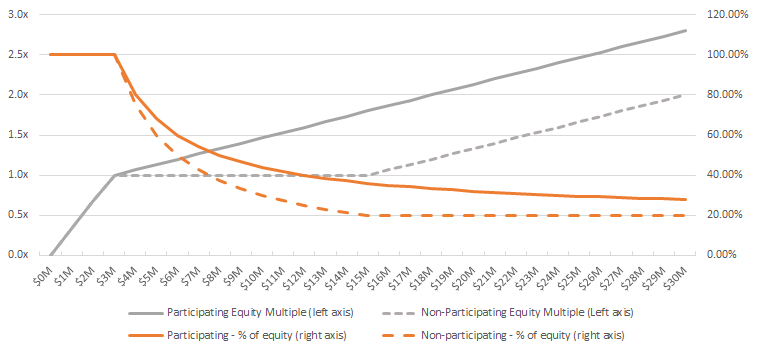

To understand the impact of both from an investor perspective, below is a chart with different exit valuations (from $0M to $30M):

As you can see, participating gets the fund a higher multiple and % of equity in all cases (but out of the money).

⚠️ Point To Negotiate:

- Make sure it’s a non-participating preferred

6. Drag-Along

This is an overlooked yet quite important term. This will typically say that if 51% to 85% of the shareholders agree to an offer, the rest of the shares will not be able to block the transaction.

In early stage, VC funds typically will have that number so that their vote is needed. The least a VC fund wants to do is find the next unicorn and being forced to sell it just a year later just because the entrepreneurs could. Classic case of “sold too early”.

⚠️ Point To Negotiate:

- % of the drag while being reasonable

7. Vesting

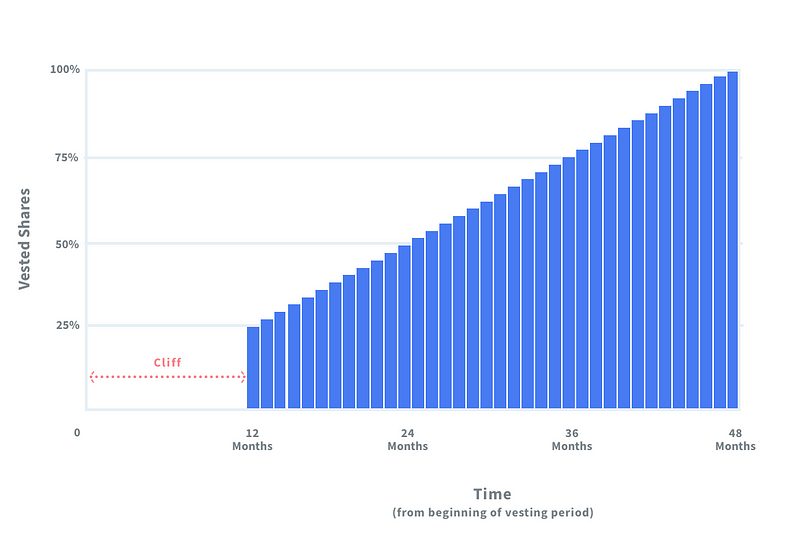

As discussed in our article Should You Ask for Equity in the Basics, your equity will always start vesting after a fundraising round. Even if you have been at the company for 5+ years, the investor wants to make sure you will stay with the company after the investment. Therefore don’t be surprised, the vesting will typically reset at every round.

⚠️ Points To Negotiate:

- Months vs Trimesters vesting after cliff

- Vesting over 3, 4, or 5 years

8. Ratchet

Our last term today will be ratchet. It can be positive (🧘) or negative (📉). It’s basically a promise between you and the investor to buy or sell shares of one another based on certain milestones. I.e. exceed your business plan and the investor will give up shares to you. Fail to reach certain milestones and you will be forced to give up shares to the investors.

⚠️ Point To Negotiate:

- Make sure the negative ratchet isn’t too punitive. You may strongly believe in your business plan but not all startups are able to deliver on their BP.

With humility, we walked the talk and tried to find the right balance : Here is Newfund's termsheet. If you want to continue this conversation, please reach out at salim@newfundcap.com