How Startups from the USA to France are Embracing the AI Wave

7 out of 10 Newfund startups have incorporated AI into their business, and the trend is accelerating.

Since 2010, artificial intelligence has seen groundbreaking developments, especially in the past two years with the advent of transformers and GPT-like models. This technology has democratized powerful AI tools, allowing startups of any size to harness previously unimaginable capabilities to drive growth and efficiency. As each wave of AI innovation offers new possibilities, it also introduces new challenges and risks of disruption.

To better grasp this phenomenon, we wanted to explore how startups at the forefront of innovation have chosen to take on the AI wave. We have compiled insights from 80 French and American Newfund companies spanning diverse sectors, from Aircall's cloud-based call management solutions to Umiami's innovative plant-based meal alternatives, to produce a study on the latest AI trends and their implications. We have enriched this study with the use cases shared by startups during the Newfund AI Booster program launched since December 2023. This initiative is aimed at supporting Newfund's participation in their AI journey by learning from concrete applications.

The Reasons Behind AI Adoption in Startups

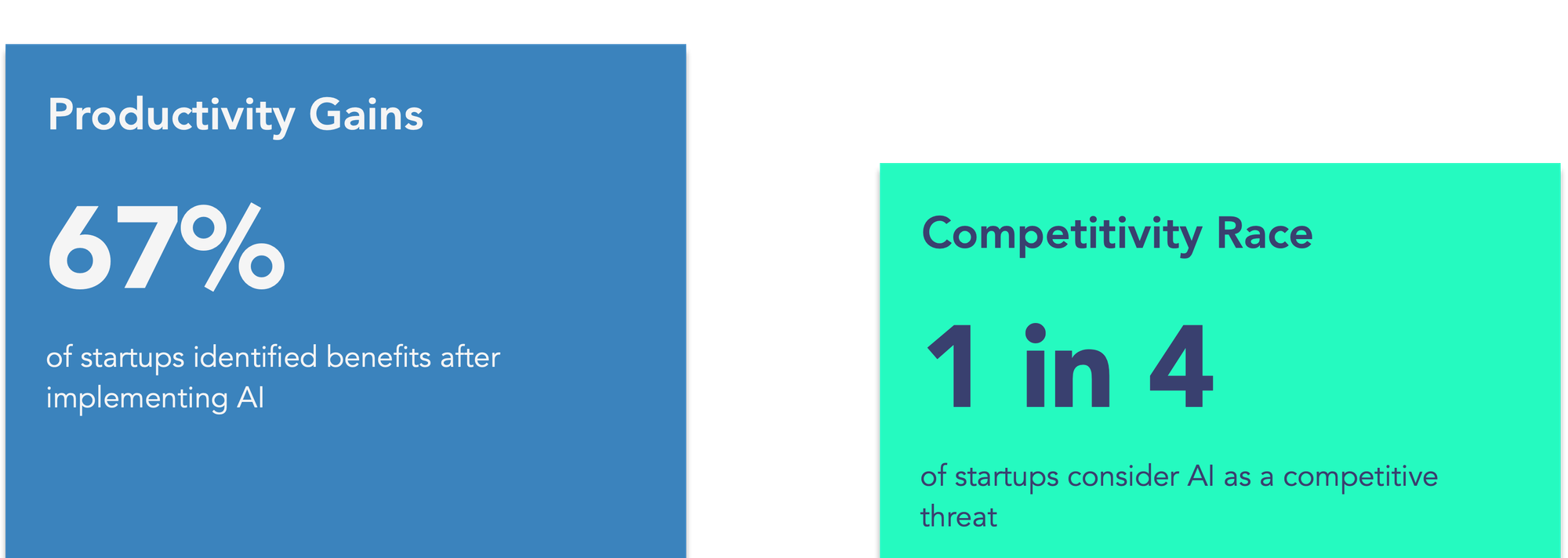

The arrival of GPTs has turned knowledge management sectors, typically associated with high costs, upside down. 67% of startups saw immediate benefits in productivity after AI implementation. Indeed, good developers may experience a tenfold increase in productivity or work quality, accelerating the whole product discovery while reducing support center costs. Significant opportunities are emerging alongside decreasing barriers to entry.

"AI, specifically machine vision (with GPT-4 vision), has 1,000X-ed our speed, accuracy, and quality of data capture, validation, verification, and enrichment. This is the heart of our business, and since implementation, we’ve seen amazing results in customer response and many other areas. We also use AI for copy, tutorials, and many other areas internally and on customer & user-facing tech." Joseph Rutakangwa, Rwazi

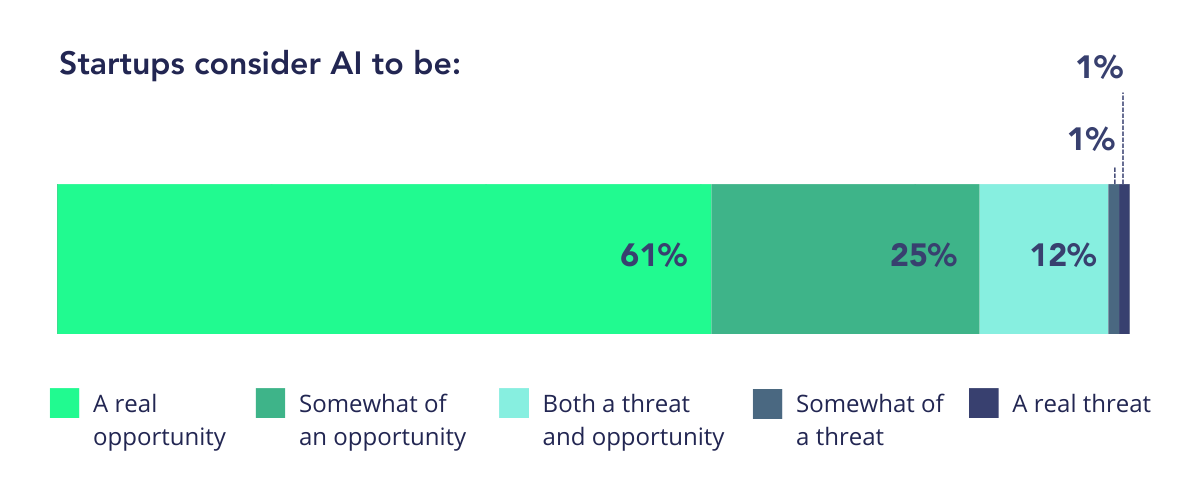

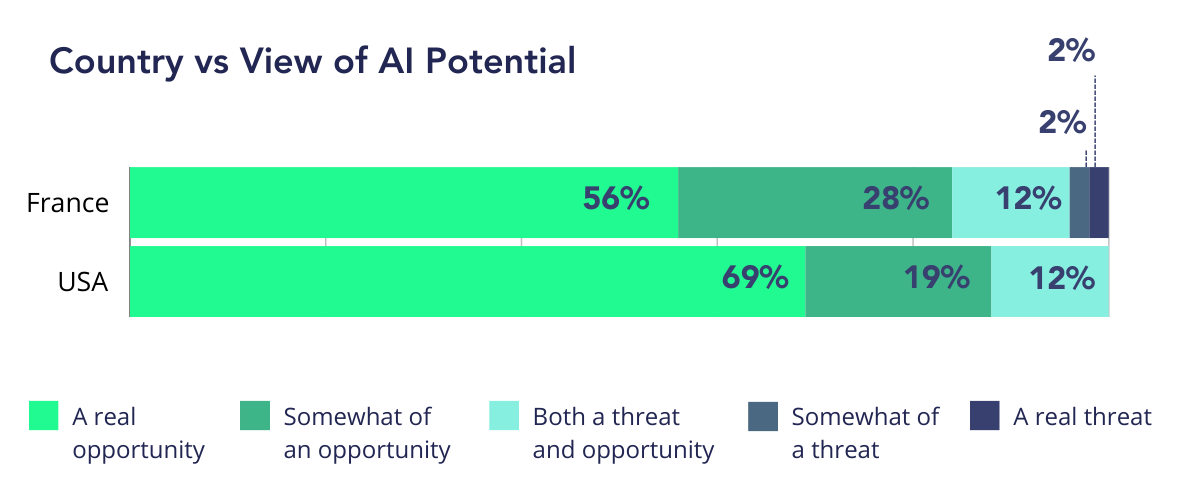

Not surprisingly, an overwhelming 98% of the start-ups see AI advances as an opportunity for their businesses. However, behind this enthusiasm also lies a rising concern: the threat that existing competitors or new entrants beat them by leveraging AI more effectively, such as cloning their product but better, faster, and with fewer resources using GenAI. As Advitam CEO Philippe Meyralbe explains, "The only threat is to not use [AI] before competitors as it'll provide major productivity gains". In our study, 2 in over 5 startups that see AI as an opportunity have cited the rise of AI-boosted competition as a significant threat.

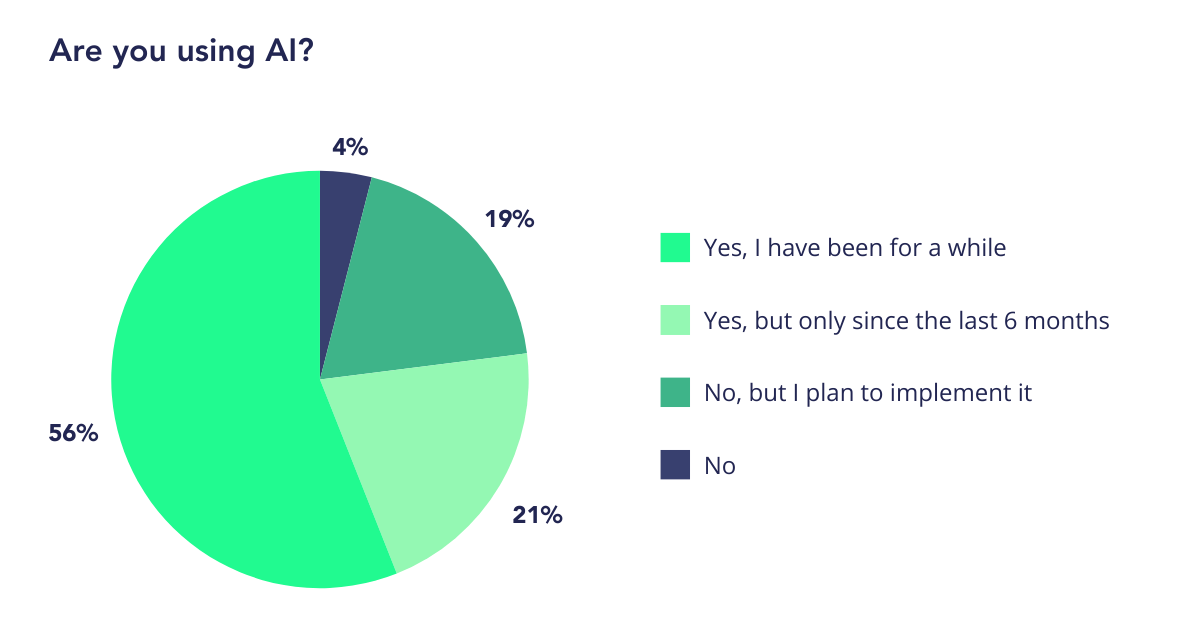

Given the combination of those factors, our companies recognize that overlooking AI's potential is inconceivable: 96% of respondents are either already using AI (77%) or they plan to implement it in the near future (20%). We've seen an acceleration in this trend, with 21% having begun to implement it in the last six months.

Eager to support this growing trend, Newfund has strived to give startups access to the latest resources through the creation of an AI Booster program, where 10 founders shared with their peers their AI developments, including customer chatbots, sales speech optimization tools, and content production resources.

From core product to internal optimization, how are our companies using AI?

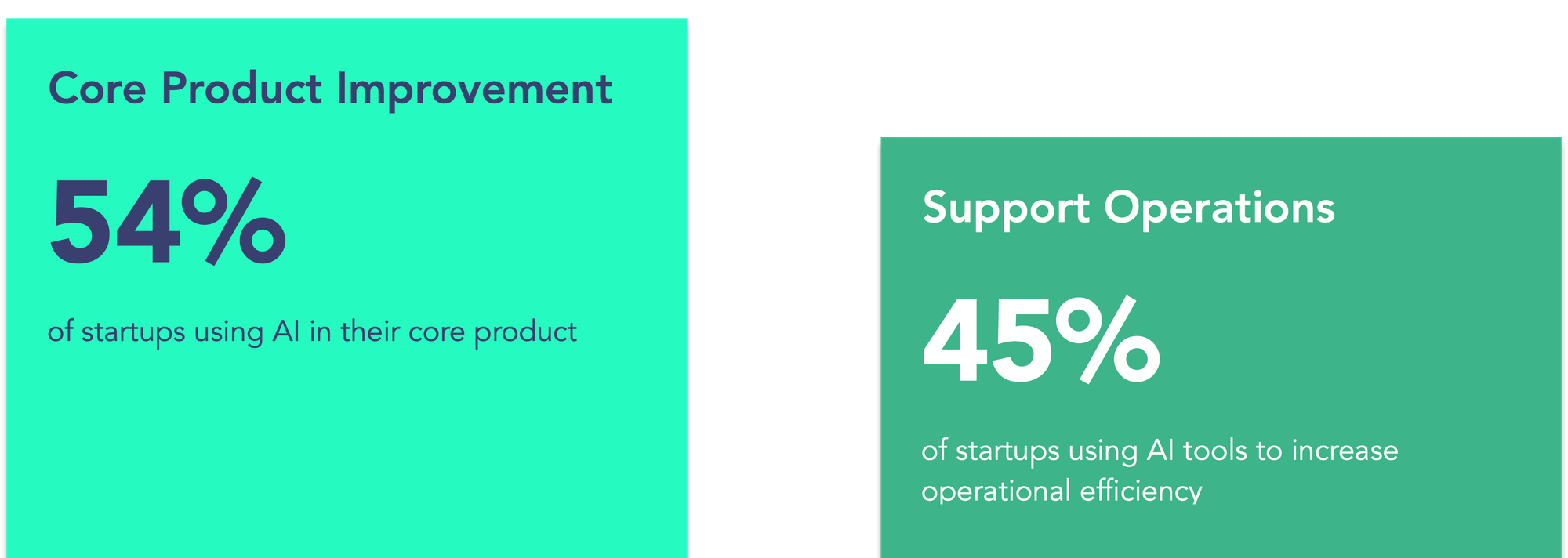

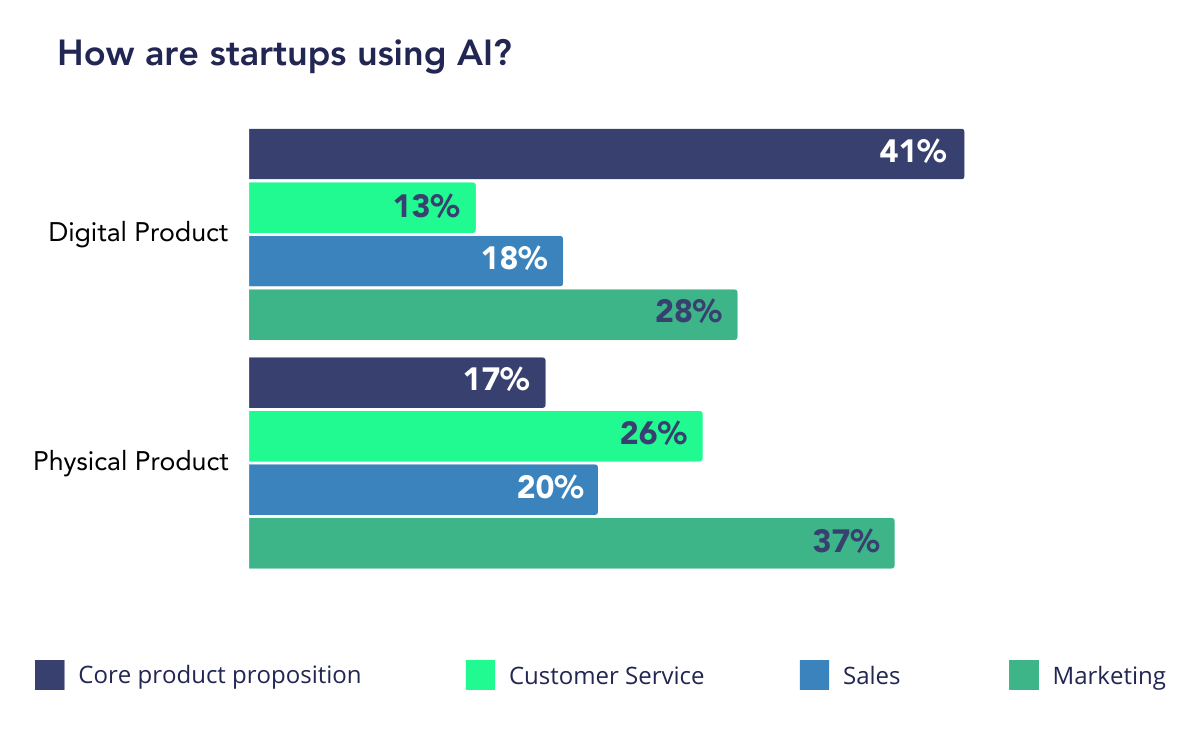

All startups focus on creating, prototyping, and optimizing a product. Thus, for many, integrating AI into this process has been a logical path to follow. 67% of software as a service (SaaS) startups, such as Aircall, Fairmarkit, or Visage, have identified implementing AI into their core product as a key priority. Others choose to build from scratch and use AI as a differentiator.

Even startups that manufacture physical products, which make up 1/3 of respondents, are already using AI. 21% of them, including Reev, Invoxia, or Tageos, aim to improve their product with AI. This confirms the notion that all companies, regardless of their sector, seem to recognize the vast potential of AI in seemingly every sector.

Outside of engineering teams, Artificial Intelligence is often used in other departments, ranging from marketing to sales, in order to improve efficiency and reach further goals: better analysis, more insights, new use cases... 46% of our startups have expressed their desire to see AI implemented in content creation, sales or customer support.

Sales optimization has also been heavily impacted by AI progress, with 1 in 4 startups having already begun improving their sales process through the use of dedicated AI platforms like Modjo.ai. While such changes may seem effortless or straightforward to implement, and the marketing claims remain strong, the timing, resources, and investment needed vary wildly based on the expected outcome.

Buy or build? Startups prefer being hands-on, not without challenges

Using AI deep into one's processes is challenging. For example, to integrate AI to the core product, the primary obstacle is possessing both the knowledge and the capability to implement AI effectively. The most successful adopters, in that case, are typically those with an established process culture. In order to prototype effectively, it is necessary to identify a product’s area of improvement, as well as the needs that need to be filled, and to have the proper agility and courage needed to invest in that product. For a startup, this means arbitrating between a traditional product roadmap and exploration. The second obstacle is the team's adoption of new tools or functionality under development. LinkedIn is always enthusiastic about the "Top 16 AI Tools Everybody Uses Today", but in reality, teams are often suspicious or reluctant to change. A clear AI integration roadmap featuring prototypes, small repeatable wins, and internal training has been a consistent theme throughout the Newfund AI Booster webinar series.

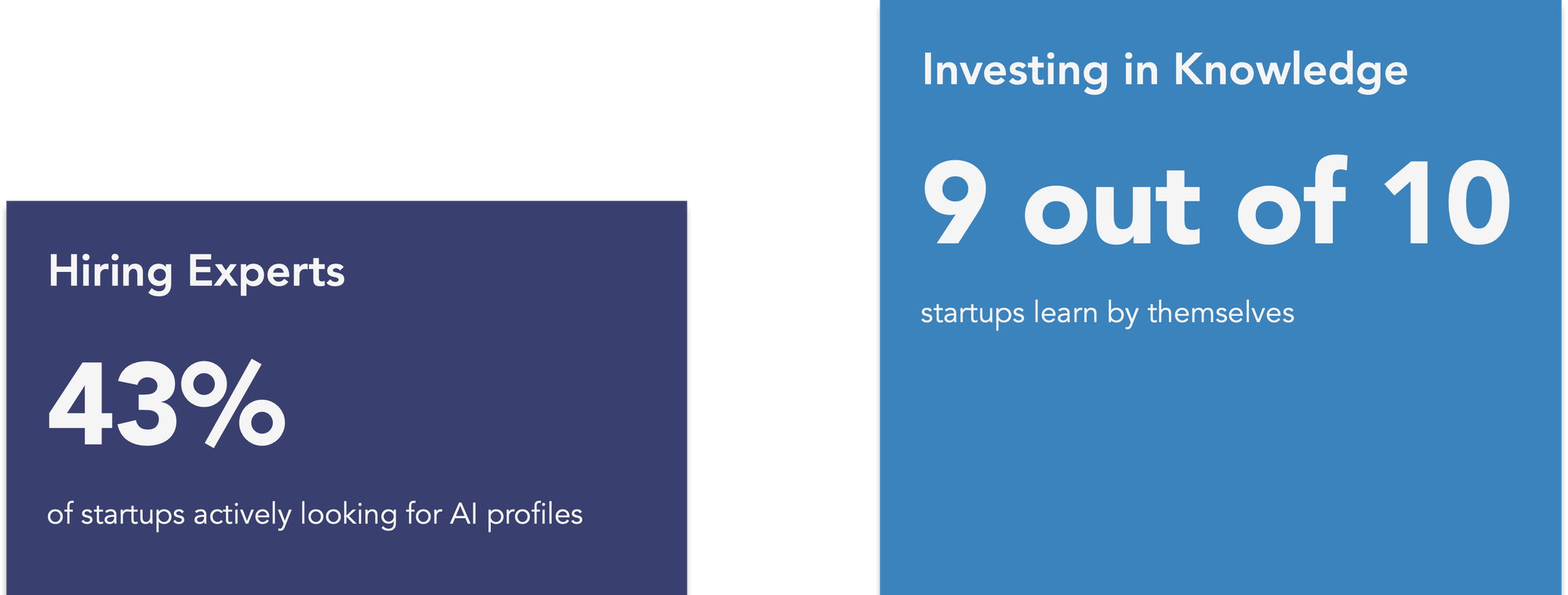

"Anybody can use it without any skill and therefore lack the proper amount of control to be sure you are not misled. Training and control are key." Fabien Hénaut, CetteFamille

The ‘hype’ surrounding GenAI generates tension on talents who are not only able to prototype but also to produce complete, mastered systems (cost + output), which feeds the competition. Our study demonstrates that 84% of respondents learn about AI through a combination of self-learning and self-taught initiatives and that companies spend about 50% of their R&D time on prototyping in order to learn and discover more solutions. This is often a pragmatic choice from our startups: with few talents available, high prices, and a need for tailored solutions, the hiring approach has a lot of inertia, restrained talent pool, and ramp-up constraints, which are greater than doing it in-house.

Even though slow and expensive, the need for AI expertise is as strong as ever: half of our startups are hiring or plan on hiring for this role. LLMs and GenAI profiles are more up-to-date and self-taught, navigating and benefiting from a dynamic environment. This is the tricky part of hiring for AI, as it’s harder to rely on a proven track record. More traditional AI profiles are found in academic talent pools, where the bigger challenge is finding someone who can fit in a startup mindset.

Although the French ecosystem benefits from talents, founders, and engineers coming from world-renowned AI and engineering schools, most of them are lured by US-based companies with deeper pockets and a thriving, risk-prone ecosystem. How are our startups embarrassing this competition, and how do they deal with a European Union centered around legalization rather than innovation?

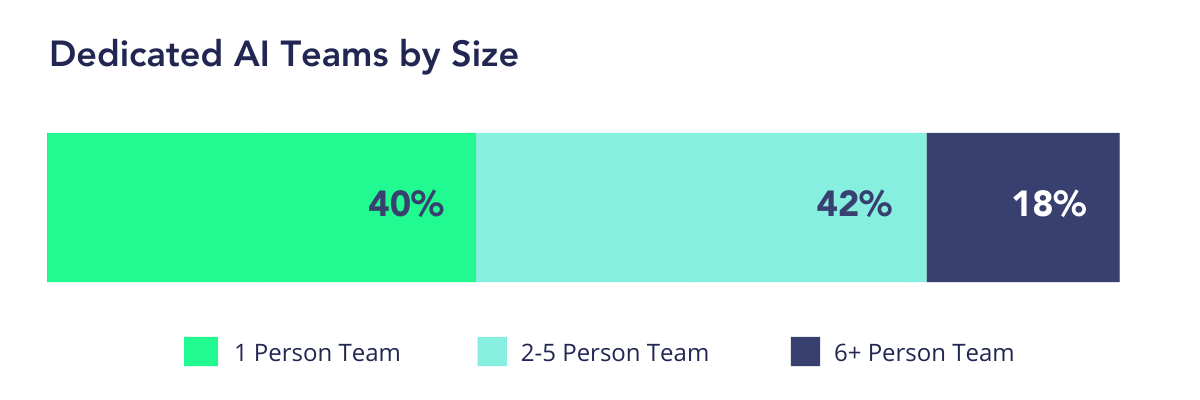

Investment-wise, Greenkub set up a team of one full-time developer plus a part-time one over several months to prototype and develop an MVP of their solution. Others rely on PhDs or interns for the research and then integrate it into the product roadmap. In our study, 40% have up to one dedicated AI profile, another 40% have between two and five people, and the remaining 10% have a bigger AI team with at least six people.

On this side, startups expect support from their investors through connections to credit programs, tools and access to tools especially early access ones, educational support & learning materials and finally access to a curated network of consultants to move fast.

"AI Booster webinars are a great idea. Keep helping us get educated, best course of action." Stephane Ibos, Keypup

Another learning is that implementing AI into a startup differs greatly based on its size and capacities. Newfund MSMEs concentrate their efforts in particular on marketing and product improvement, in order to remain relevant towards their competition. 78% of companies who want to bring profound improvements to their core product actually have less than 50 employees.

Larger companies, on the other hand, do not have to find their product-market fit and thus mainly focus on support sectors, including sales optimization or customer care. Aircall’s CTO highlights that “embedding AI in both sales and customer support workflows and augmenting agent productivity based on AI” stands as an opportunity for their sector.

Narrowing the Cross-Atlantic Technology Gap

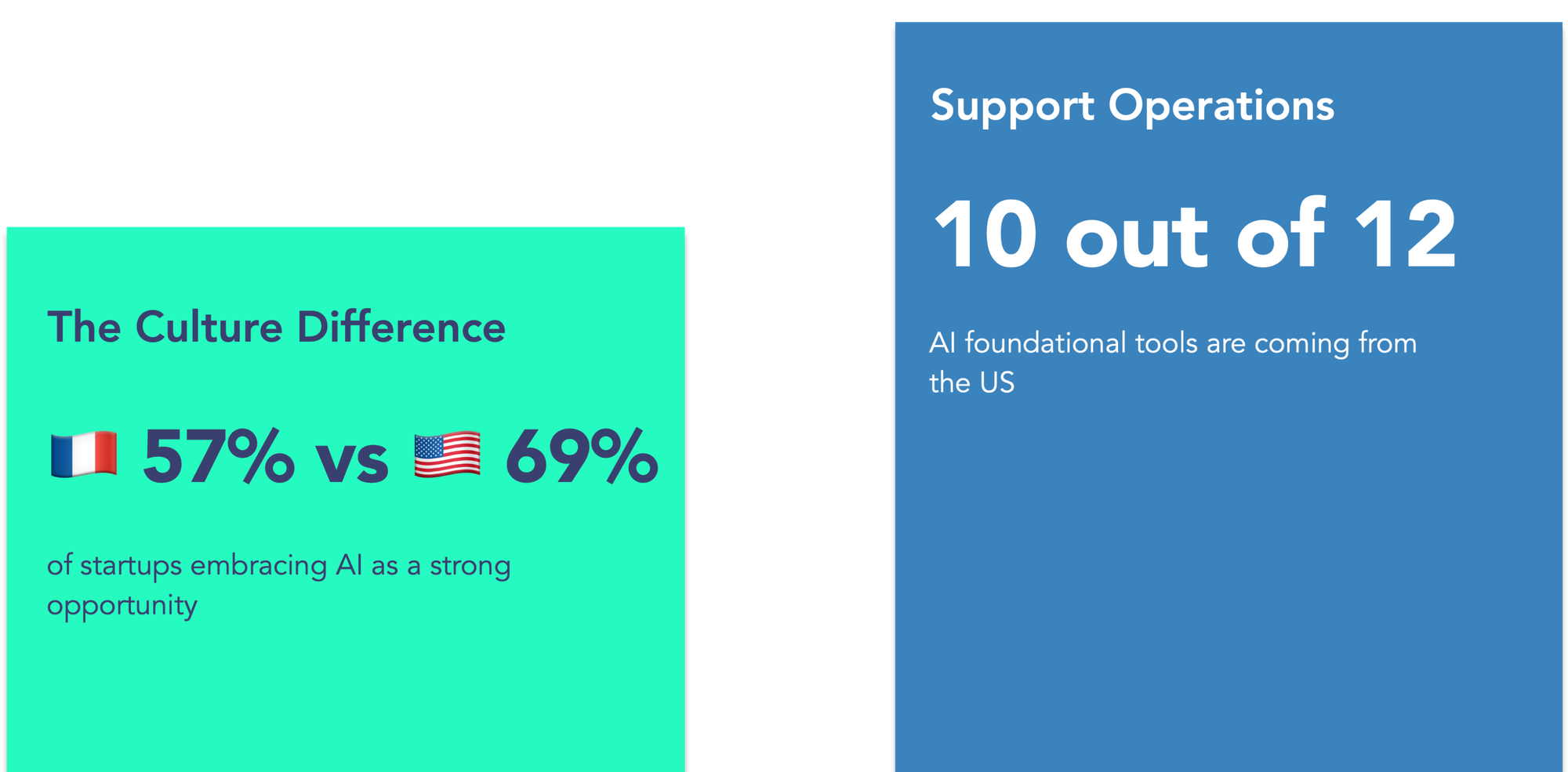

In the realm of AI, the divergence in attitudes between the United States and France is noticeable. American startups typically view AI as a vast field of opportunity and have consequently established some of the biggest names in the industry, such as OpenAI and Gemini. In contrast, French companies, while also recognizing AI's potential, often approach it with a mix of optimism and caution, sometimes even perceiving it as a threat. This difference in mindset has led France to adopt a follower strategy, reacting to trends rather than setting them.

In our study, 46% of French startups that use AI have reported using OpenAI’s services. Besides Mistral, most startups choose to rely on integrated models offered by American AI startups, such as Modjo. Americans' options are the preferred choice for most: OpenAI services are used by 27 respondents, while Mistral is in second place and is used by 4 of them. This is mostly due to OpenAI providing a cheap, accessible, and first-class model as a product and as an API. The 2022 GPT wave was also strongly linked with ChatGPT until other alternatives rose up, and they reaped the lion’s share of the market.

Other models like Mistral or Llama arrived later and started as self-hosted alternatives, which required engineering skills to deploy and a bigger upfront investment than OpenAI. This is less true now, as they also provide API access and move forward on commoditization.

Newfund startups reported that the main factors behind choosing another model or provider were:

- Regulatory compliance (GDPR, Sovereignty)

- Savings at scale (pay per-use with services vs flat fees for self-hosted options)

- Better results for specific use cases, like code generation, speed, accuracy

- Credits giveaways (e.g., Google giving Gemini / Vertex.ai credits for Google Cloud Platform users)

This disparity stems largely from cultural differences in risk tolerance and strategic focus. American firms are known for their willingness to embrace risk and push the boundaries of innovation, backed by substantial funding that fuels their ambitious AI ventures. In 2023, the USA's private investments in AI exceeded 67 billion US dollars, compared to about 1.7 billion US dollars in France. French startups tend to be more cautious and deliberate, reflecting a more academic approach to innovation. This is compounded by the European Union's strong regulatory environment, visible with the EU AI Act, which sometimes slows down the rapid tech adoption. Additionally, the greater financial resources available in the U.S. lure talent away from France, which often trains individuals who then move to the U.S., further exacerbating the gap.

Despite these challenges, France is not without its strengths in the AI sector. The country is home to world-renowned engineering and mathematics schools, and the French government has recently announced a significant investment in AI, with a €10 billion fund to promote this technology. Notable French AI companies like Mistral and HuggingFace underscore the capability of France to produce influential AI players. Moreover, French startups are keenly aware of the importance of AI in penetrating and succeeding in the U.S. market, viewing it not only as a competitive landscape but also as a vital expansion territory. In our study, 95% of French startups had already integrated AI or are planning to do it in the near future.

This situation aligns with the strategy advocated by Newfund: leveraging local capabilities to create lasting champions. By focusing on reliability, adaptability, and the effective use of existing resources, French startups can position themselves as formidable players in the European AI arena. Viewing the U.S. market as an opportunity for expansion rather than mere competition could be key to international and local success, embodying a strategic approach that turns potential disadvantages into strengths.

Conclusion

The integration of AI into startup ecosystems marks the beginning of a new era in technological advancement and competitive strategy. From France to the USA, startups are embracing AI not only to enhance their product offerings but also to streamline operations. The primary motivation for adopting AI is to achieve significant productivity gains and remain competitive competitiveness in a rapidly evolving market. Even though American startups are more likely to dive headfirst into AI adoption, backed by substantial funding and a less stringent regulatory environment, both French and American startups want to benefit from AI and dedicate time and resources to develop internal knowledge.

At Newfund, we are proud to support this transformation. Our presence in both France and the USA places us in a unique position to support startups willing to adopt an AI-based strategy. We stay connected with the latest trends from Silicon Valley, providing a strong support network for founders aiming to succeed in the U.S. while also leveraging France's rich talent pool and research capabilities. To stay relevant and a step ahead, Newfund invests internally to take the AI turn and build expertise. Everyone should join the race!