The SleepTech Industry: an Investor Perspective

Introduction

We have decided to dedicate a series of articles on the BrainTech market to show our investor perspective. After discussing the Brain Technology Revolution, Brain and Nutrition, BCI, and Psychedelics, this fifth article deals with the SleepTech industry.

The SleepTech industry is defined as ‘the sector of technology and innovation focused on improving and enhancing various aspects of sleep, as well as monitoring and analyzing sleep patterns and quality.’

This article will focus on emerging technological products and exclude sleep economy companies like Casper Mattresses or sleeping tablets. We will see that some Sleep technologies could use BCI technologies, and others will be only software-based—one more reason to consult our BCI article if you haven't already done so.

Sleep disorders are a growing issue in all Western societies. They have always existed but are now diagnosed and considered pathologies. Combined with lack of sleep, these disorders have multiple repercussions on the general state of health of the individual (aggravation of symptoms of associated somatic or psychiatric illnesses: chronic pain, hypertension, depression...) and also social impacts (absence from work, productivity, risk of accidents...). According to this McKinsey study, the economic costs of sleep deprivation are estimated at more than $400B annually for the USA alone. There need to be solutions found to these costly issues and this is where new technologies could be an answer. SleepTech has therefore received a growing interest in the last few years from academia and the industry. Entrepreneurs decided to bridge this gap to enable the distribution of these technologies.

Our aim is to understand the first emerging technologies and the trends that have shaped this market to learn from past experiences and understand which companies will perform in this new industry.

Starting point

Major discoveries in the field of sleep mechanisms and sleep disorders were made during the 20th century, with key milestones such as the discovery of Melatonin in 1958 by Dr. Aaron Lerner and the identification of sleep phases in 1968 by Allan Rechtschaffen and Anthony Kales [ref].

While significant scientific discoveries may not have occurred in the last 20 years, Dr. Emma Chabani (Ph.D.), a sleep specialist at the Human Design Group, shared with us that most recent scientific studies focused on the consequences of sleep quality. All these new studies have contributed to raising awareness of sleep's vital role in overall health, cognitive function, and economic impact.

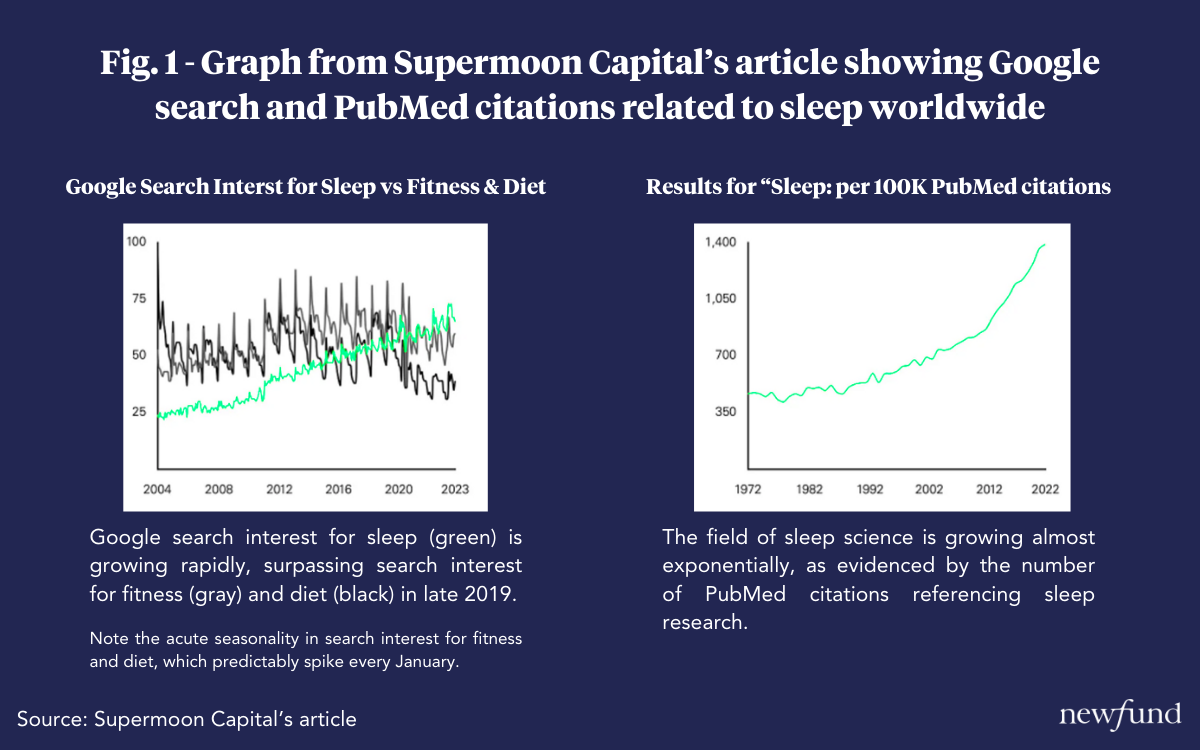

As Supermoon Capital, a US VC fund fully dedicated to Sleep-Techs, also highlighted in their comprehensive article on the subject, scientific research on the impact of sleep boomed from 2012, and so did the interest of the mass population around the topic, as shown below (Fig.1). Technologies have therefore reached maturity and jump from labs to daily life applications.

Growing interest from the industry and the investors.

This scientific focus on sleep has encouraged entrepreneurs and innovators to develop sleep-tech solutions. Dr. Chabani has been benchmarking the sleep-tech landscape and concluded that the scientific basis for sleep technology is solid and has been built upon decades of research. Two technological advances support the increasing amount of sleep-related innovations:

- Miniaturization of sensors: Sleep-tracking devices like smartwatches and headbands have become popular as sensors have become smaller and easier to wear. These devices provide valuable sleep-related data and insights into sleep patterns.

- Data collection and AI algorithms: Sleep-tracking wearables generate vast amounts of data, including heart rate, movement, and brain activity. This data can be analyzed to improve AI models and make them more reliable, and autonomous.

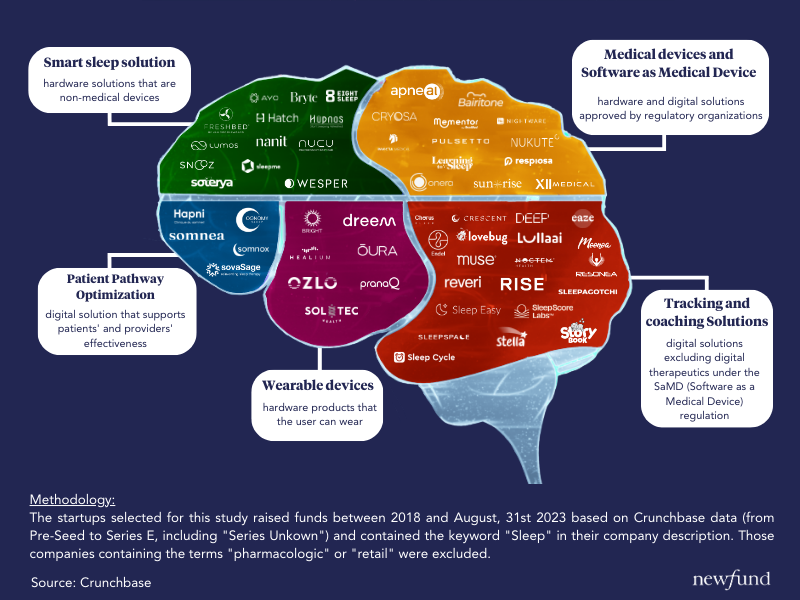

As a result, many startups have been emerging in the sleep sector. We have gathered some of them in the following mapping:

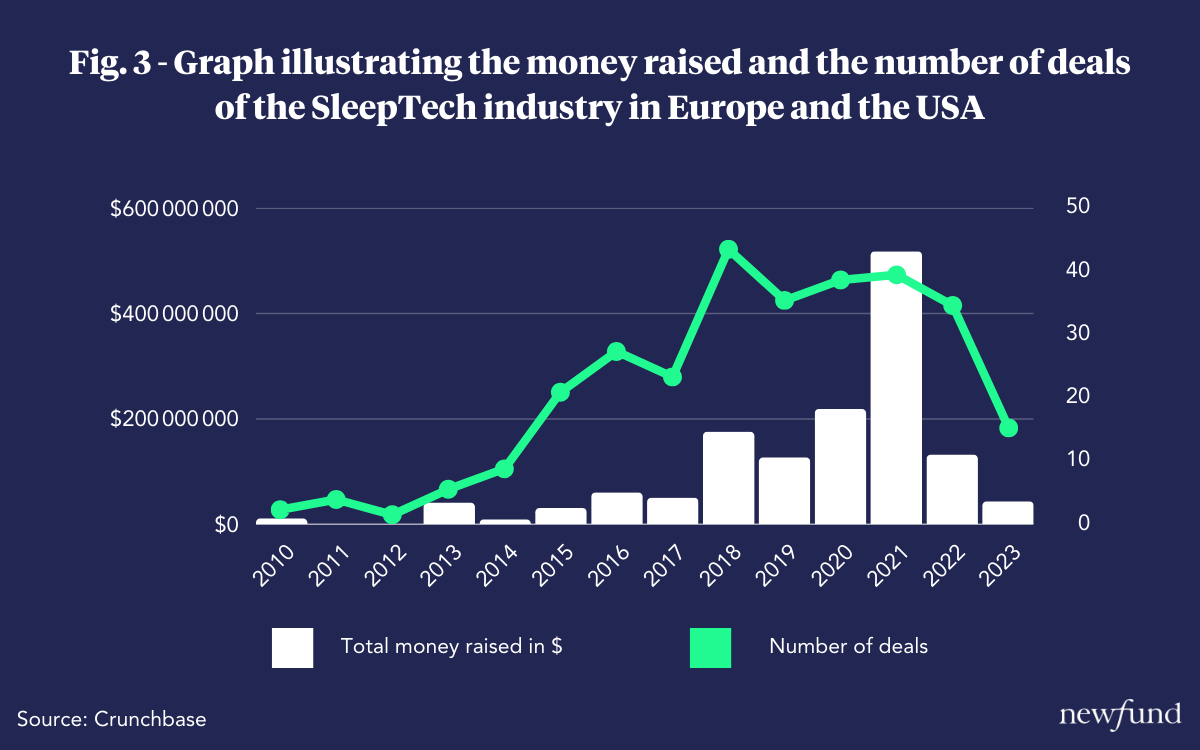

Interest from venture capitalists in sleep technologies has been steadily increasing since 2010, with a significant surge in the amount of money invested in 2018 (as shown in Figure 3). More than one billion dollars were invested in SleepTech during the past years.

The 2018 boom was driven by the number of startups funded, which doubled compared to 2017, and by the $20 million-plus funding rounds from sleep technology pioneers such as Dreem, Invicta Medical, and Whoop.

The second peak in 2021 is more a consequence of global VC trends that year and the amount of available money for investors. As the number of deals remained stable compared to the previous years, massive rounds were closed by Oura and Whoop ($300M for these two deals alone!). These companies attract wellness specialized funds like Next Ventures or B2C funds like Forerunner Ventures and significant, generalist investment funds like SoftBank Vision Fund.

Even after the massive VC downturn of 2022, the number of deals remained high in the SleepTech industry (28 deals in 2022), and this trend is confirmed for 2023 (10 deals were made during S1 against 14 in S1 2021). This highlights a continuous interest for investors in this sector.

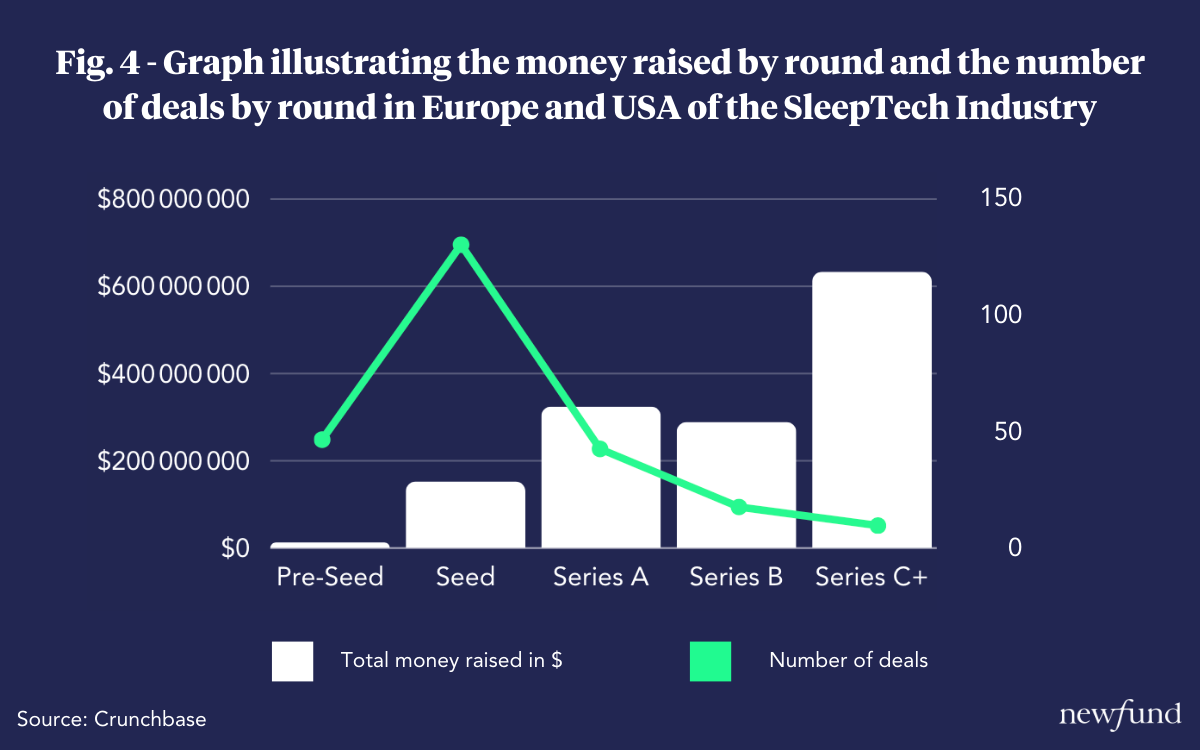

Looking at the stage decomposition of these deals since 2010 (figure 4), the main observation is that Seed rounds represent almost 50% of the total number of deals. Still, later stage rounds represent nearly 90% of the total money raised. This trend suggests that VCs are willing to invest in new ideas and innovation in the industry, with many early stage investments. Still, they are also looking for evidence of growth potential and a clear path to profitability to continue with later stage deals. Once they get it, they are prepared to invest heavily to support the growth of these emerging champions.

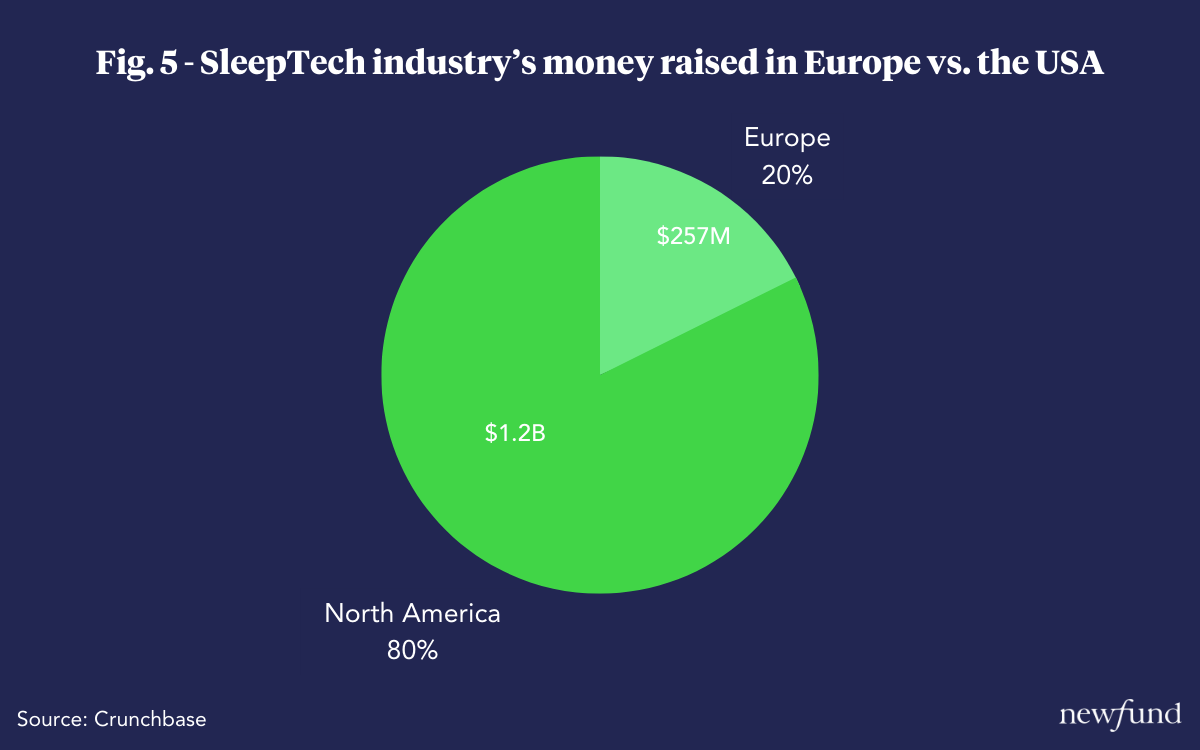

In terms of geography, American-based companies benefited more than 80% from the money invested by VCs in SleepTech over the last ten years, as shown in the following chart:

A trendy sector, but with visible failures…

Despite these significant investments, we're seeing the first failures in the sleep tech industry: Some companies have found it hard to move beyond the happy few and target another category of individuals. The propensity to pay was finally limited, and other payers had to take over (B2B). In this B2B space, SleepTech companies face another challenge: the rigorous scientific validation demands from potential corporate buyers for obtaining reimbursement. Unlike consumers, businesses and health systems require strong scientific evidence or regulatory clearance to justify adopting sleep tech solutions.

Additionally, adopting a new behavior and using a new device over time is a big consumer gap. Only powerful results can drive this. Mainly when there are significant user frictions: it may seem obvious, but sleeping with a headband is simply not pleasant.

A relevant example is the company Dreem, which used to be the French flagship of SleepTech. They made a significant pathway with $57 million in funding and a successful B2C model. They successfully sold tens of thousands of their innovative sleep-tracking headbands. They, however, reached the limit of the cash-consuming direct-to-consumer business model and decided to pivot to a B2B approach in 2020.

This change of strategy resulted in a late focus on clinical results, and despite rigorous scientific validation, Dreem faced challenges in obtaining sufficient warranties before running out of cash. Consequently, their assets were recently acquired by the company Beacon Biosignals, signing the end of Dreem’s adventure.

Dreem’s path is a good example of the challenges encountered by SleepTech companies: adoption either by consumers or the medical community is key, and creating stickiness often requires changes in users' habits. Companies must find a strong and reliable business model to reach the mass market beyond early adopters.

… And encouraging success stories

The industry's pioneers have paved the way for other players seeking to conquer the SleepTech market. We have made a non-exhaustive selection of some companies in the SleepTech area:

- Some of them clearly show that people wonder about their sleep, and concerns emerge in the global population. To increase adoption most of these companies also combine the capabilities of the products with lifestyle tracking of fitness applications :

One of the most notorious sleep-tech success stories is the Finnish company Oura. They reached sales of more than 1 million units of their sleep tracking rings last year and hired today +475 employees worldwide. Overall, ~$150M have been raised by Oura (Source: Crunchbase), weighing significantly on the amount raised by the SleepTech industry in Series B + rounds.

Oura has achieved great success in the market due to various factors. One of the most significant factors is creating an elegant, easy-to-wear design that caters to both men and women. It is clear that using an object that has already been worn, such as a ring, reduces the risk of adoption refusal.

Moreover, Oura has a strong scientific foundation that enables them to offer reliable data to their users, which is crucial in the health and wellness industry. The company has invested significant resources in research and development, and it has paid off in terms of the reliability of its product's data. They also proposed additional features such as advanced temperature tracking which was very popular during the COVID pandemic.

Finally, a crucial part of the success of the Finland-based startup is its early US expansion to capture the market's massive business opportunity and leverage a first community of biohackers.

Whoop is a Boston-based company founded in 2012, and it has quickly become a game changer in the SleepTech industry. Whoop proposes yearly subscriptions and provides a wearable fitness tracker that helps users optimize their performance and recovery. The company's flagship product, the Whoop Strap 3.0, is a sleek wristband that tracks various metrics related to fitness, including sleep, heart rate, and recovery. The strap is designed to be worn 24/7, giving users a daily recovery score that helps them understand how ready their body is for physical activity. They raised overall ~$400M to date at a $3.6 Bn valuation on Aug 30, 2021.

Here again, one of the key factors contributing to Whoop's success is their focus on the science behind sleep. The company has a team of scientists and sleep experts who have conducted extensive research on sleep and recovery. They have used this research to develop a product that provides users with accurate and actionable data on their sleep patterns.

Another factor that sets Whoop apart from its competitors is its user community. Whoop has created a community of users passionate about sleep and fitness. This community shares their experiences and advice on social media, which has helped to create a strong brand identity for Whoop, and they become ambassadors of the product. The company has also successfully partnered with professional sports teams, including the NFL, NBA, and NHL. These partnerships have helped to raise the profile of Whoop and establish it as a trusted brand in the SleepTech industry.

Eight Sleep aims to transform the sleep experience with technology and data to help people lead healthier lives. Their Smart Mattress, equipped with temperature control, sleep tracking, and a gentle wake-up feature, is the cornerstone of their success. They use data-driven insights to offer tailored solutions to customers, promoting better sleep health.

In the world of parenting, sleep is a luxury. Nanit recognized this and transformed how we improve babies' sleep. Founded in 2014, Nanit uses cutting-edge technology to monitor and enhance infants' sleep. The Nanit Sleep System combines a high-definition camera with advanced computer vision technology to give parents unprecedented clarity and valuable insights. Nanit is committed to data-driven parenting and provides personalized advice to improve sleep quality. With features such as two-way audio, real-time alerts, and secure cloud storage, Nanit has brought peace of mind to parents worldwide.

With over 2 million active users and a presence in 150 countries, Sleep Cycle is one of the most well-known companies in the sleep monitoring industry. The Sleep Cycle app utilizes advanced algorithms and smartphone sensors to analyze users’ sleep patterns and offer personalized insights for better sleep quality. It tracks sleep stages and includes features like intelligent alarms that wake users during their lightest sleep phase, leading to a more refreshed morning. Their popular app allowed them to perform the first IPO in the Sleeptech industry, but their expansion remained limited. Their solution focuses on sleep cycle monitoring and identifying the optimal waking-up time. However, the demand for medical responses to global sleep issues is increasing. While lifestyle apps like Sleep Cycle may be considered nice to have, we believe that medical solutions capable of significantly improving overall sleep quality have the potential to become ten-billion-dollar companies.

- Other combine usability and strong scientific validation :

NYX is a company that uses an innovative approach by tACS (transcranial alternating current stimulation) to personalize the stimulation for each individual using a closed-loop system. This means all insomnia patients can fall asleep faster and have a more qualitative and refreshing sleep night after night. Not only does this technology help with insomnia, it aims to treat sleep disturbances associated with Parkinson’s disease. This is an essential aspect of the disease that NYX is actively working on addressing. By tackling this issue, NYX is helping to alleviate the burden of the disease for those who suffer from it.

Apneal is developing a mobile app that helps diagnose sleep apnea using a smartphone. Today, diagnosing sleep apnea is challenging for patients as polysomnography (PSG) requires them to sleep at the hospital with a bunch of sensors to monitor many body functions such as brain activity, eye movement, skeletal muscle activation, and heart rhythm. Patients often don’t even know they suffer from it and don’t undergo this process. Apneal makes an easy and at-home pre-diagnosis of sleep apnea with relevant scientific data.

This second emerging category is up and coming, and we hope to see more startups in it.

Conclusion

SleepTech is becoming trendy, and many startups have emerged in this new market. However, success stories remain very rare. While early adopters have demonstrated the demand for sleep-related innovations, several fundamental principles guide our investment approach:

Firstly, scientific validation is crucial. Startups in the sleep tech sector must prioritize robust scientific research with rigorous protocols and strong scientific committees. This enhances credibility and aligns with the growing demand for evidence-based solutions.

Secondly, regarding the business model, attempting to pivot from a B2C model to B2B after reaching the limits of early adopters can be challenging and lead to a loss of focus. Many B2C companies were targeting huge markets, arguing that everyone sleeps. The reality turned out to be that the requirements for technological solutions were not strong enough, and the accessible market was much smaller. Finally, in terms of geography, the United States represents an ideal market due to the interest from the investors, well-developed sleep infrastructure (more than 2,500 sleep clinics), and users who are less reluctant to use technologies to improve every aspect of well-being and a higher willingness to pay by some tech-savvy community.