Portfolio analysis in trying times

With the Covid-19 crisis hitting all data points at full speed, valuations as of Dec 31st, 2019 became obsolete. We needed a new tool to assess the health of our portfolio for internal prioritization as well as LP reporting. In this article, we share our methodology as implemented at the end of April 2020.

Part I: Situation analysis

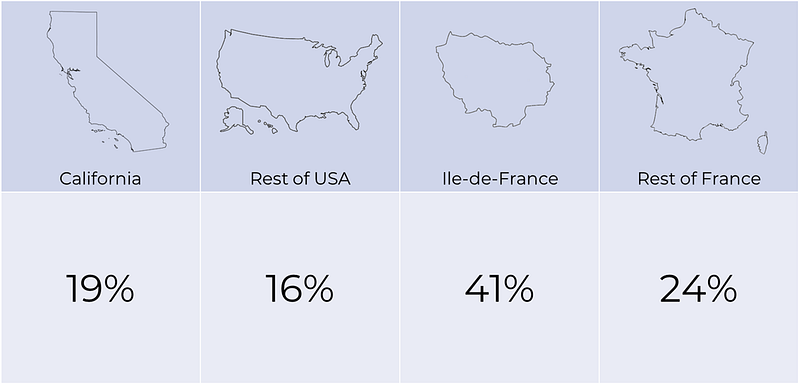

Newfund has 55 active portfolio companies in France (65% of portfolio value) and 30 in the US (35% of value). Below is our portfolio split by geography:

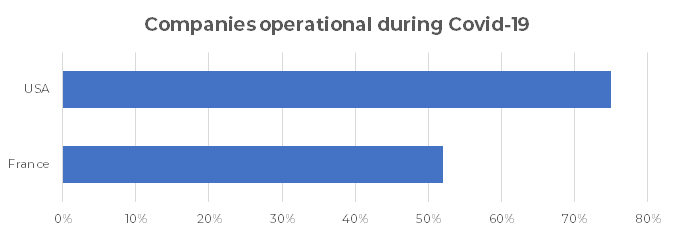

In the week of April 20th, we conducted a survey with our 85 startups. 98% participated. The first conclusion was that the slowdown was more evident in France than in the US. Just 52% of french startups remained operational* compared to 75% stateside. A more constraining french confinement likely plays a big factor.

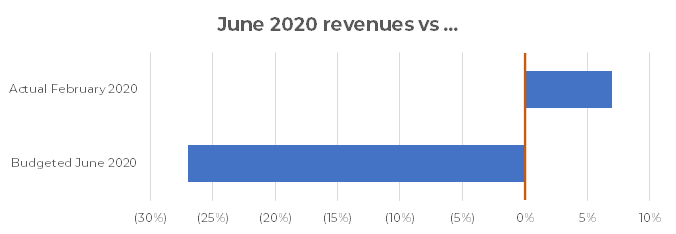

And despite these news, there is optimism on the horizon. Companies expect June 2020 revenues to be 32% lower than budgeted but 8% higher than February 2020.

Again, numbers were a bit more optimistic stateside, with just 18% of new June 2020 projections lower than budgeted and expectations 10% higher than February 2020.

In terms of non-dilutive financing, 70 companies (out of 85) applied to government programs, mostly via Activité Partielle and Prêts Garantis par l’Etat (PGE) in France and the Paycheck Protection Program (PPP) in the US. In France, part of this additional cash translates into a debt burden.

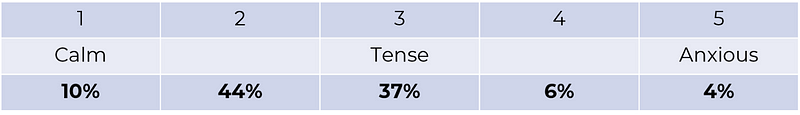

Finally, 83% of our companies will pursue some form of remote work until the end of May and in terms of emotions, 37% of our entrepreneurs feel tense but only 4% are anxious. This is probably due to more visibility into the sanitary crises and governments on both sides of the pond stepping up with various economic stimuli.

With this in mind, how is Newfund doing its part with all stakeholders?

Part II: Potential analysis

Valuation of portfolios used to rely for the most part on a combination of two simple methodologies, both based on what we see in the market: the last round and a multiple of a forecast (sale, typically). When markets are on a roller-coaster ride, this does not work any more. Moreover, at Newfund we tend to be suspicious of forecasting. Reality very seldom fits into past projections, which are often a way to reassure oneself more than a tool for action.

Remember the work of Amos Tversky and Daniel Kahneman. To understand the future you must precisely avoid projecting the past, which is a task that is extraordinarily difficult for the human mind, as the authors so brilliantly demonstrated.

So we stepped aside these projection-based methodologies and went to examine the strengths factors of our start-ups. The rational being that even if we do not know where we are going, agility depends on some key factors that can be identified even in the middle of the storm.

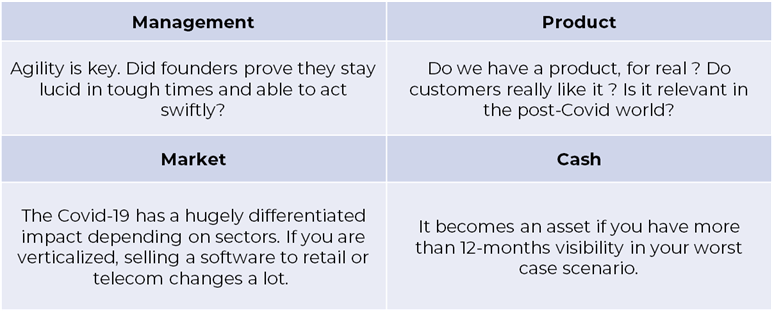

So we rely on a simple method to evaluate start-up potential based on the 4 following fundamentals:

The grading is simple: 0 or 1.

0 for not mastering the criteria.

1 for mastering it.

Criterias tend to be objective questions to avoid the grader’s biais.

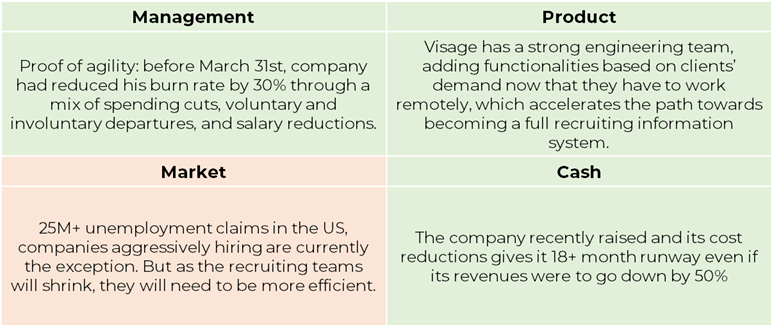

To give you a quick example, let’s look at Visage (and an interview of the founder).

Visage is therefore a 3 in our eyes and could become a 4.

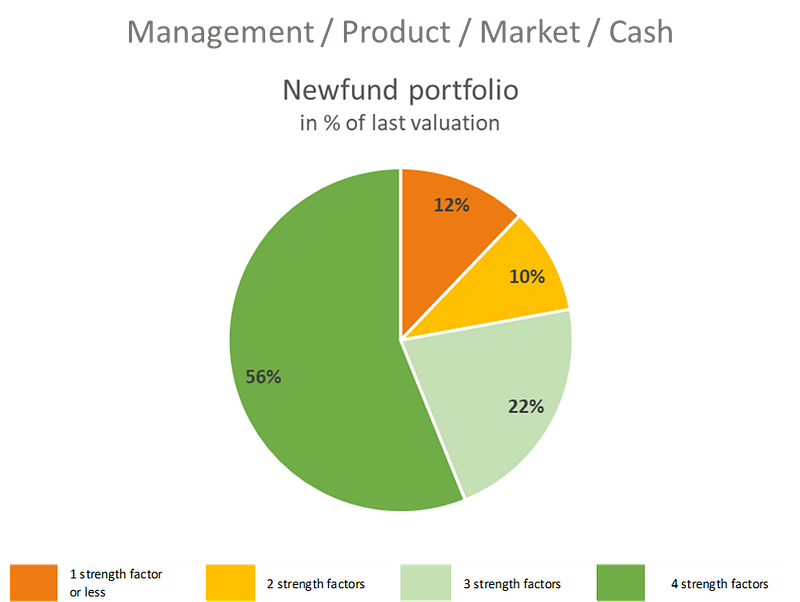

The more strength factors a start-up has, the more it can face uncertainty and react positively to events that were impossible to forecast. The number of strength factors should be closely related to the ability to navigate the crisis and the potential to emerge strengthened and create value during the period.

Call us optimists, but this is how our general dashboard looks like right now with our rating methodology.

We are lucky enough that the first episode of the crisis somewhat validated the start-up that we valued most as of December 31st, 2019. No strong line at that time is in a market segment hit hard by the Coronavirus or in the process of fundraising under constraint. In times of crisis diversification is an advantage.

The above analysis and further details were shared with all our LPs. We organized a webinar to present the results and address potential questions. Less is more? Regardless, in complicated times where it’s hard to predict a few months from now, a simple analysis speaks a thousand words and has allowed us to remain as agile as we expect our startups to be.

Your feedback is priceless, feel free to ping us at vera@newfundcap.com.