Your Series A check sheet ✔️

If you prefer to download directly the check sheet, download is here.

Newfund recently announced its 3rd series A refinancing in a row over the last three months. First came FairMoney with Flourish Ventures & DST partners. Then Fairmarkit with Insight Partners. And a few weeks ago, came Young Alfred with Gradient Ventures, Google AI fund.

They all had in common: $10M+ Series A, american VC funds leading the rounds, and their Product Market Fit (“PMF”) validated. Their road to value creation and social success remains long, with plenty of work and roadblocks ahead.

In this article, we share learnings from their experience raising their Series A in order to help all entrepreneurs raise their Seed, Series A, or even Series B. We found 6 criterias common to all three startups that were essential in assessing their Series A readiness and here they are:

1. Repeatable use case

At the heart of a Series A is the validation of a product market fit, a repeatable use case perfected during the seed round. At Newfund, we now use the “Superhuman method”. Inspired by Rahul Vohra, the founder of Superhuman, it tries to quantify the PMF of any company through statistical analysis. All seed companies should ask themselves the following:

Ask your users how they’d feel if they could no longer use your product. The group that answers ‘very disappointed’ will unlock product-market fit.

You can read more here and I recommend you apply this strategy if you haven’t already.

⚠️ Recommendation: A clear slide on how your users are addicted to your product, and are paying for it.

2. Recruitment

During its post-seed period, a company needs to work on clearly separating the roles of the founders and showing an ability to hire key talent. It’s not about hiring executives and removing yourself from the business. Rather it’s showing you can convince quality people to join your business even though the road is still long and free yourself to focus on the next business challenges.

⚠️Recommendation: Be able to show some key hirings over the course of the past few months. A fully staffed C-level is not necessary and you will probably not have the money to fill all positions; 1 or 2 is enough — and it is already a huge feat!

3. KPI driven

You raised a seed round on few if any financials but rather a team of founders, a vision, and some early traction. Series A is meant to push you on your go-to market. The size of the check that VCs are going to write is substantial, burn rate will increase dramatically and the source of failure that everybody wants to avoid is premature scaling. And believe me, it is a very common source of failure. Hence a lot of the due diligence will be on the metrics and your ability to monitor your progress.

2019 state of tech investing:

— Andrew Chen (@andrewchen) September 1, 2019

Pre-seed- Bet on the entrepreneur 👨💻

Seed- Bet on the team 👨👩👦👦

Series A- Bet on the traction 🏒

Series B- Bet on the revenue 💸

Series C- Bet on the unit economics 💰

(Had to add the emojis, I know, this tweet is social media pandering)

Here are some KPIs to focus on:

- MRR

- Cohorts / Churn

- CAC / LTV

- Usage of your service (not just MAU but rather usage in terms of minutes or number of daily connects)

The idea behind these metrics is to see if your instruments are ready to scale : if you do not have the data and the right mindset of tracking every area of performance and source of improvement to correct it and enhance your organization, you will not get them later down the road.

⚠️Recommendation: Identify your KPIs and show a clear positive trend. Read this piece by Point Nine Capital if you’re a SaaS business:

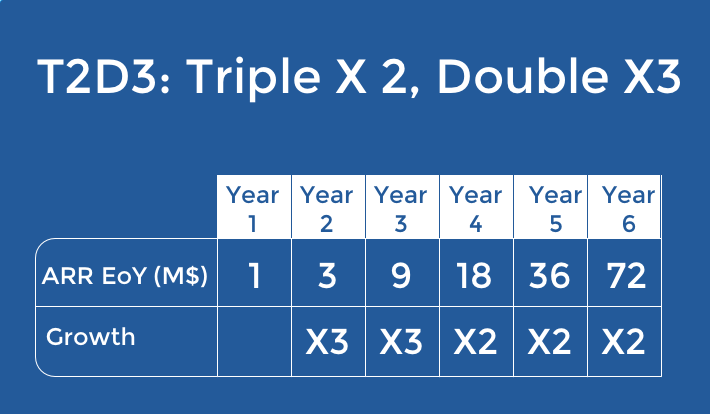

4. Growth

In the earlier section, we talked about the different metrics you need to master. Regardless of how healthy they are, remember that growth is key behind valuation. A valuation becomes more rational (hence more based on financial metrics hence often lower) as growth slows down. A 2x in revenue y/y is a minimum, a 3x helps a lot in the fundraising process. Or between 7% and 9% of monthly growth.

⚠️Recommendation: Look for growth before your fundraise, or else get into skeleton crew mode. For more info on skeleton crews, must read by Sahil Lavingia:

5. Equation

Needless to say, one part of the deal is the equation. To validate a potential series A, you need to reach the famous 100k of MRR (slowly moving to 200K of MRR in the valley). At that number, you can easily justify (in November 2019) a fundraise of 4M to 10M, at a valuation of 10M to 40M.

Check out this presentation excerpt from a class I give at HEC and Epitech on how to determine valuation and how much you can raise (in France) inferred from current revenues.

⚠️Recommendation: talk to your peers (those who recently did a Series A not wannabe Series A or Seed) to check your feasible round size and expected post-money dilution.

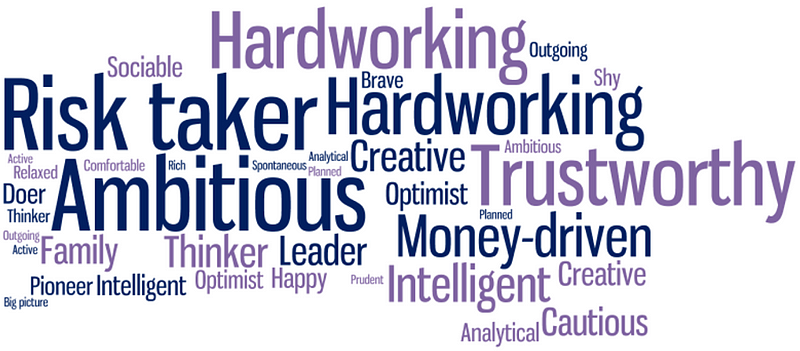

6. Personality

The worst answer a VC can give you after saying no is “too early for us” 😷. I heard it so many times as an entrepreneur I promised myself I would try to say as little as possible as a VC (I am guilty though I try not to say it at all). So I typically give valid reasons for why there is no potential equation between Newfund and the founders.

But one aspect we can never really mention is if there is a lack of human compatibility. Venture capital invests in all types of entrepreneur but there are certain aspects, certain traits common to all. Like mentorability. Mentorability is key because as much as investors want someone stubborn, they really mean a stubborn listener. Below are a few more adjectives of the typical entrepreneur :

⚠️Recommendation: If you don’t know if you’re mentorable, you must watch this:

What’s next?

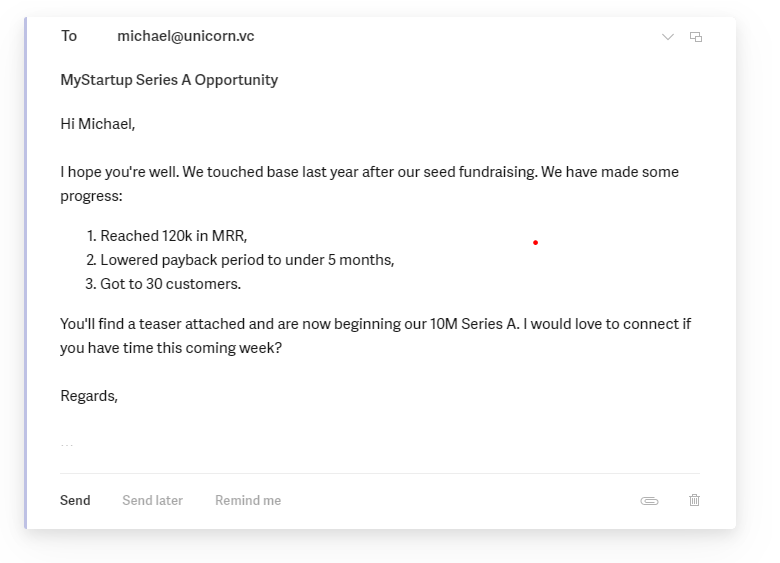

Get a list of qualified VC funds. Email them directly with a quick email like this:

VCs invest in 1% of deals they receive. Statistically you could be facing the same odds. So don’t let yourself down (ever).

Two quick tips:

⚠️ Not all co-founders need to go to first or second meetings.

⚠️ If the VC asks for a fourth and a fifth meeting, and you don’t see the end in sight, then he/she is probably stringing you along.

Good luck, you can do this! And once you do, congrats on graduating your seed class!

Download our series A check sheet here. (We don’t need your info).

Your feedback is priceless, feel free to ping us at salim@newfundcap.com.