Why We Invested in Agora Place?

This was written in January 2018. This is very pre-covid but we thought we would keep it online to show you what an investor's life was.

Below is the start to finish story on how we invested in Agora Place:

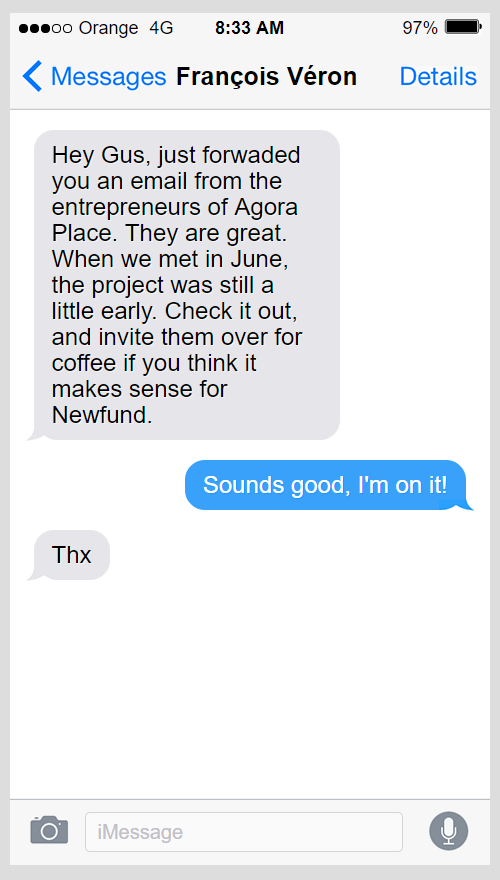

It all started with a simple message from François (Véron — co-founder of Newfund Capital):

What is first admirable from these entrepreneurs is that despite the initial “it’s too early at this point” answer that we gave them back in June, they did not take it personally, matured their growth, strategy, and came back knocking on our door a few months later. All entrepreneurs should not be discouraged by an initial no and actually use it as motivation to succeed!

Day 1

I probably get 10 emails a day from entrepreneurs currently fundraising. All are at different steps in their adventure and I often want to meet them all, at least to see how I can help. With time constraints, I end up meeting just 2 to 4 a day.

I scroll through Reynold and Tanguy’s email (Agora Place’s founders), open their executive summary, and look at their business plan. The executive summary was 10 pages long (perfect length if you ask me), and highlighted its strengths. The growth was constant month over month, and a quick google search for customers’ feedback made me confident the entrepreneurs were onto something. I decided to call Reynold, just a few hours after receiving his email. This is almost exactly how it went:

Me: “Reynold?”

Reynold: “Yes, who’s on the phone?”

Me: “Augustin Sayer, from Newfund Capital”

Reynold: “Hey there, wasn’t expecting a call just yet.”

Me: “Want to come to the office tomorrow at 1030AM?”

Reynold: “Sure.”

And just like this, meeting had been set.

First Meeting (Actual Day 2)

Tanguy and Reynold came at 1025AM in our offices. (Quick obvious advice: always show up 5 minutes before your meeting, never show up right on time or late). I always have an hour reserved for meetings with a 30 minute buffer to avoid being late to my next meeting.

We have four meeting rooms at our HQ. The orange room, the square room, the circle room, and the board room.

We ended up meeting in the cold square room. I offered them an americano, espresso, tea, or water. TBH I’m not quite sure what they ordered with yours truly.

We quickly delved into the background of the founders, how they met, why they started Agora Place. Then we delved into Agora Place’s track record to date, its clients, its competitors. In a few months, they had conquered the B2B market of reconditioned smartphones in France. But their bigger aim was digitalizing the central buying service, a dinosaur so far untouched by the wave of disruption unleashed since the dot com. Their long term ambition may also include landing their service in the US, a country where Newfund Capital is now deeply rooted, with partner Henri Deshays, 20+ startups, and numerous LPs. The fund has also accompanied the likes of Aircall move from Paris to the Silicon Valley. The conversation flowed, and it is what you should expect from a successful first meeting.

What striked me:

1. Entrepreneurs with a clear vision on their business, and willing to listen.

2. Sustained revenue growth since inception.

3. Monitored spending of funds already raised. They knew their numbers to the t.

4. Entrepreneurs who re-invested all their earnings from their previous startup into this one.

I asked them to send me the presentation and their business plan in .xlsx. Ahead of the second meeting, I spent ample time playing with the assumptions and checking if my gut feeling about the entrepreneurs and the business model wasn’t too crazy.

Second Meeting (Day 8)

I quickly set up a second meeting, and decided to invite François in order to get his opinion and thoughts. We met for two hours at Agora Place’s offices at Remix Coworking.

There we really drilled down on the model. Who are the clients? Why are they coming, or why are they leaving? Why are they willing to pay a fee to Agora Place? It seemed all clients favored Agora Place to dealing directly with the buyers/suppliers for the following two main reasons:

- It was cheaper. Savings is king.

- It protected them. Together, stronger.

My main questions past this meeting were:

1. Was their technology scalable enough to support increased volume of transactions? Unscalable legacy tech can make for bottlenecks later down in the life of a startup.

2. Can they continue to part themselves from competition and towards what customers want? Or have they reached a peak to which competition is little by little climbing to?

In the end, their ticket size was about Newfund’s average for a seed round (between €300k and €4M). We have our executive committees once a week (every Monday at 930AM to be exact - It typically runs an hour) which validated our investment thesis.

Discussions (Day 8–64)

This is the part that you don’t hear much but that takes most of the time in the life of a deal, especially between the lead investor and the entrepreneurs. And as much as it may not look like it, discussing the valuation is the easiest process for both the investors and the entrepreneurs.

Over the next 8 weeks, we discussed with the entrepreneurs over:

1. Valuation — a few days

2. Cap Table & finalizing who the additional investors would be— 1.5 week

3. Shareholders’ Agreement — 2 weeks

5. Accounting due diligence — 1.5 week

6. Legal due diligence — 1 week

Early December, the deal was pretty much ready. Until signing, there are always frictions that are beyond the control of either entrepreneurs or investors.

It is important too that entrepreneurs realize that accepting a VC in their life will bring their company more legal & financial structure, but that the latter requires some near-term efforts that will fructify only in the long run. Before you even start fundraising, get familiar with terms such as ordinary vs preferred shares, tag along, drag along, etc… (Plenty of good articles on the subject).

At the end of the day, we had a great fit with the entrepreneurs. They were serious, motivated, and had a clear vision on how to disrupt the industry. With our Operating Partners, Newfund Capital also offers ad-hoc services such as marketing, human resources, and finally just being an experienced sounding board, available most hours, most days of the week. The latter services are especially useful for lean startups and is obviously free of charge.

When I was an entrepreneur, I only focused on valuation when talking to VCs and missed the point that the big picture remained in the fine print below the numbers, and who you get married to. I also recommend you plan your fundraising carefully. If you have no experience at all, ask your friend who has worked in banking, or investing. Ask a fellow entrepreneur who has already closed a round. Ask me if you’d like, I’d be happy to help, I have raised money for my startups multiple times.

Signing (Day 65; or 9 weeks after first contact)

After finally coming to an agreement on all points mentioned above, we decided to meet at 830AM at our lawyer’s offices a few days shy of Xmas. Around Starbucks coffee, we reviewed all documents, signed them, and annotated all pages.

Signing day is exciting. For both entrepreneurs and investors. Entrepreneurs can sleep knowing they will be able to make the next payroll, but mostly that they now have the dry powder to accelerate their development. Investors are thrilled at the idea of accompanying the entrepreneurs in this endeavor. Let’s disrupt this together, and make the life of store managers across the world better!

FYI

While a Medium post summarizing this deal may make it seem easy, it’s not quite the walk in the park you could expect. It’s patience and hard work. Happy to listen to your own story.

Check out Agora Place on https://www.agora.place

Your feedback is priceless, feel free to ping us at salim@newfundcap.com.