Newfund's latest term sheet

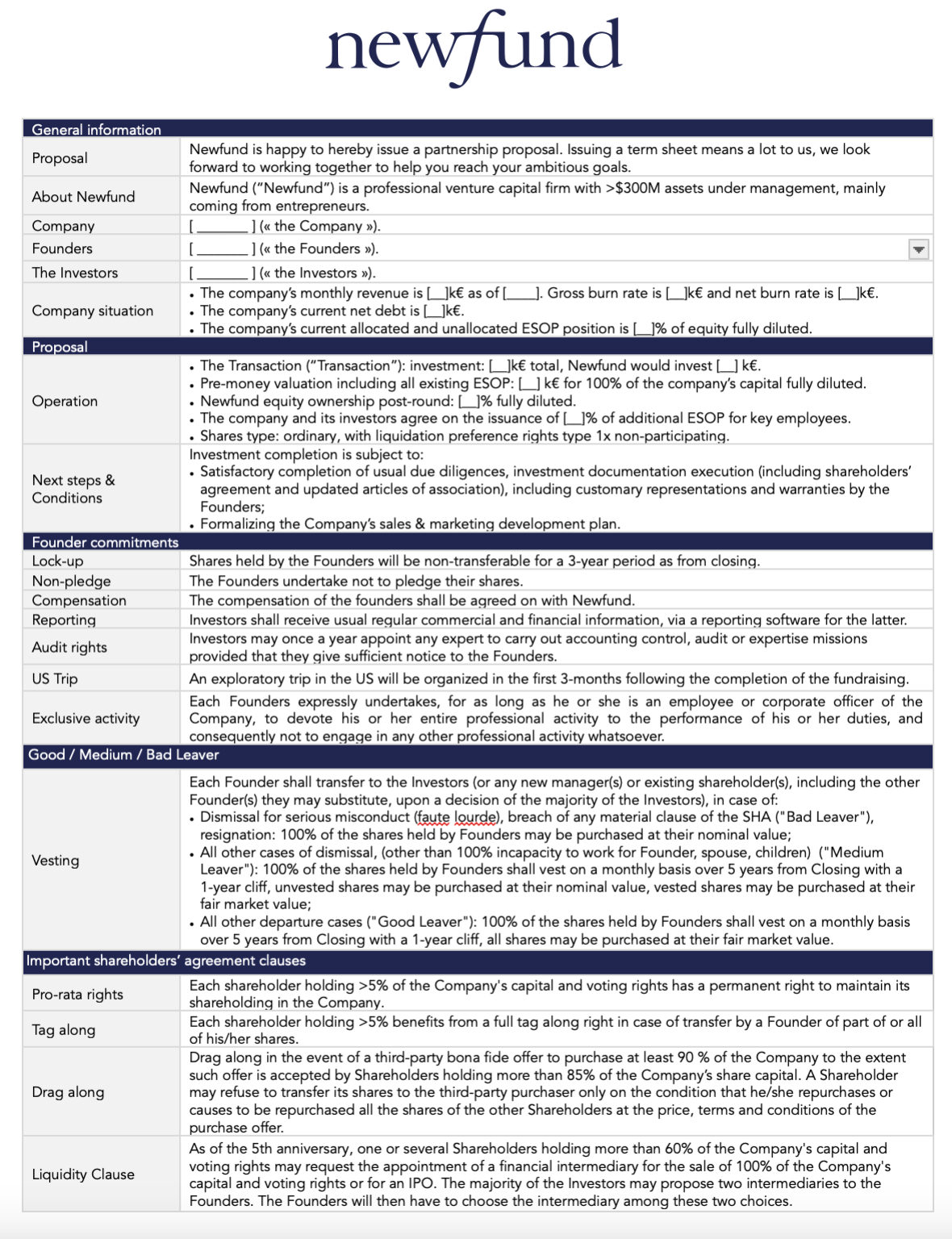

We released a new version of our term sheet in order to minimize the back and forth with founders

In France, it takes too long to close a deal: 12 weeks on average. Precious time that could be dedicated to the company’s operations is being wasted in tedious legal discussions.

At Newfund, we accepted the challenge of providing founders a term sheet that fits in less than 2 pages, in order to move faster during this critical phase of the investment. Our new term sheet allows us to quickly agree on the main clauses of the shareholders' agreement and to move forward swiftly during the investment process.

A simple objective: defend the interests of all parties

Term sheets are non-binding agreements that set out the various terms of an investment. At Newfund, our objective is to defend the interests of all stakeholders: the founders are protected from the investors, the investors from the founders, the founders from each other and the investors from each other.

However, we do not pretend to settle all possible situations. Our objective is to have a document that encourages a balanced dialogue: no party can camp on its position without taking into account the others. We are doing our best to reflect the fundamental balance of the early stage VC deal: entrepreneurs must be able to move forward fast, which is why we do not have any governance clauses such as budgetary rights, etc.; and investors must be able to protect their investment, in particular by participating in decisions relating to the evolution of the capital.

Unlocking our term sheet publicly

In an effort to be fully transparent, we have decided to unlock our term sheet for all founders, which to top it all, fits in two pages.

If you wish to raise your seed round with us:

- read our investment thesis here to make sure there is a fit

- answer a few questions and we'll be happy to give you feedback.

About Newfund

Newfund is an early-stage VC that supports entrepreneurs driving disruptive innovation across all sectors, with a particular focus on those with international ambitions. The fund invests between €500k and €3M to help initiate international expansion, and continues to support entrepreneurs over the long term through follow-on investments. Its team of 25 professionals, based in Paris, Silicon Valley, and Nouvelle-Aquitaine, leverages proprietary technology tools and methodologies developed since the fund’s inception in 2008. The portfolio comprises over 120 innovative startups. On the LP side, Newfund has the largest network of entrepreneurs and family offices in France for an innovation fund.