Should you ask for equity 📈?

You just got that job at the startup you’ve always dreamt of and you’re wondering if you should ask for equity as part of compensation? Drawing from my time as an entrepreneur, my discussions with the 70+ hires then, and most recently as VC @ Newfund Capital helping our portfolio companies recruit new employees, below are some tips to think about before and during your negotiations.

1. The Basics ➕ ➖

Depending on the maturity of the startup, you may be offered “equity”. Most likely that equity will come in the form of stock options. It’s important to highlight the differences between shares and stock options:

One of the biggest lies in startups is that employees are “owners” in the companies they work for.

— Andrew Dumont (@AndrewDumont) June 12, 2018

Stock options are not ownership. They’re an option to buy stock at a set price, which is typically inflated and most employees simply can’t afford.

In a nutshell:

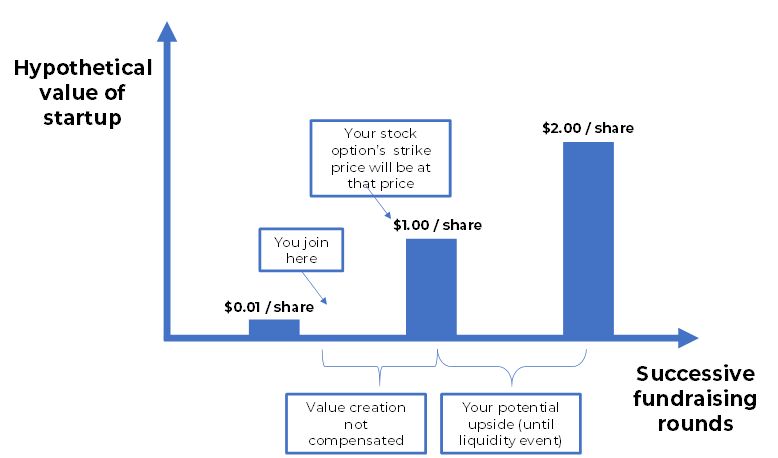

1. Stock options are not shares, they are a contracted promise to buy shares at a predetermined price (strike price) in the future.

2. You typically exercise that promise at a sale when the value of the shares is higher than your strike price.

In rare cases, some employees will exercise their promise to convert their stock options into shares before a liquidity event (exit/sale). They must have the cash handy, and be ok with the risk of shelling out hard-earned money for a company that is still bleeding VC cash. The only upside is that you become a real current shareholder.

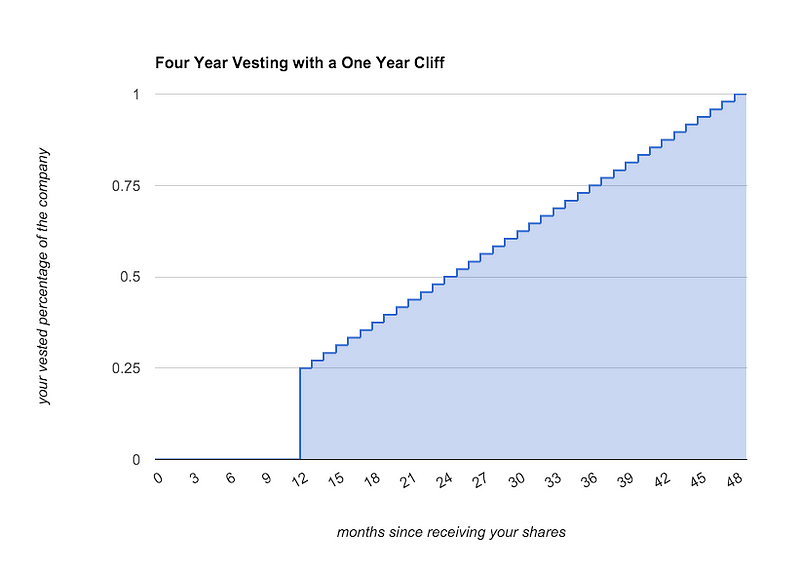

It’s also important to know that in all cases, the startup won’t give you all the promised stock options at hire. Your “equity” will likely face a vesting period of four years with a one-year cliff.

In layman terms, if you quit the company or get fired within the first twelve months, you will leave with nothing. After 12 months, your equity will catch up for the first year and then vest proportionally every month or quarter. So if you leave after two years, you will leave with half of your promised equity. This is typically non-negotiable.

Now let’s look at all fundraising rounds and evaluate whether your equity expectations make sense. [This article does NOT cover equity expectations for high profile senior hires (for eg. a Series B startup hiring a COO, or a growth Startup hiring a CEO to prep for an IPO).]

2. Pre-Seed Scenario 🥚

By Pre-Seed, I mean the company does not have revenues nor has ever fundraised. But the founders have their idea, have worked on an MVP for a few months, and haven’t paid themselves since quitting their previous jobs.

Let’s say this stage is your best shot at getting a sizeable chunk of the equity (also highest risk/reward).

The founding team is typically looking for its third or fourth employee at that point. It’s looking to beef up a department in which it lacks the right skillset (for ex. two engineers hiring a finance person, or two MBAs hiring a lead dev).

- If the company isn’t incorporated: You’re in luck, this is probably the only case where you will get shares rather than stock options. The cost of issuing and attributing these shares is almost irrelevant for the founders since it will be done concomitantly with the company’s incorporation. You can also argue to be named co-founder as your name will be on the initial registry of shareholders (I will leave that to your negotiation skills 😉). Regardless, in this case, you could expect anywhere from 5% to 30% of the company’s shares.

- If the company is already incorporated: it probably means it’s a bit more advanced than the case above. You will be promised stock options at hire. These options will be issued and attributed during the seed fundraising expected to happen 2 to 6 months after your arrival. As a result, the strike price of the options will be at a higher value point than when you joined. The longer after you join does the fundraising occur, the higher you should negotiate in terms of equity compensation. Overall, you should expect anywhere from 5% to 15% of the company.

In both cases, I would argue that devs have more power when it comes to negotiating these days. They have become a scarcity (or maybe they’ve become just too expensive for startups 😜).

Finally, as a rule of thumb, these are general assumptions. The equity stake should be adjusted for experience, seniority, needs of the company, and finally skillset. Every situation is different and I have seen people join a pre-seed startup for 1% of the capital (poor negotiation skills or low understanding of how equity works) and others basically become co-founders to receive up to 50% of shares (pro-negotiators or maybe the company was still in relative infancy).

Results: Assuming a 10% stake and several further fundraising rounds, had you joined Facebook at that stage, you would own ~$1.8B at IPO. Had you joined Whatsapp at that stage, at its sale to Facebook, you would own ~$730M. Had you joined Instagram at that stage, at it sale to Facebook, you would own ~$37M. Had you joined Mint.com at that stage, at it sale to Intuit, you would own ~$6M.

3. Seed Scenario 🐣

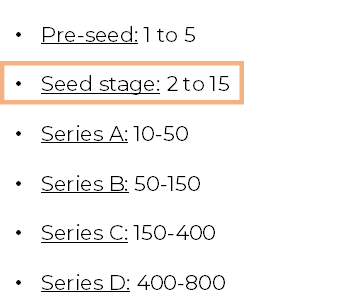

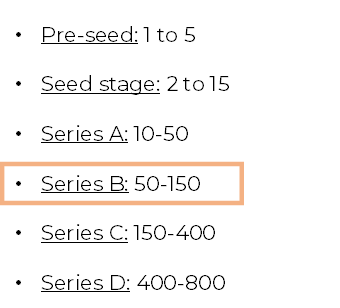

At the seed level, the startup has completed its first and only fundraise (anywhere from €300k to €1.5M). The company has already started selling its product (or service) but is looking for additional employees to help it bring it to the market and test it. Below is an average number of employees during each round:

Now let’s look at the potential options for you to ask for equity at that stage.

- The company has issued a stock option plan during its last fundraising: You’re in luck. Your strike price is the Seed fundraising share price. On average seed startups will issue from 2% to 8% of stock options (from the fully diluted shares). If a CTO is needed, he may get 1% to 4%. Other employees will typically split the rest, adjusted for experience, seniority, needs of the company, and skillset. You typically can ask for 0.25% to 2.0%.

- The company has NOT issued a stock option during its last fundraising: Then it’s a little trickier again. You will be promised stock options that will happen in the next fundraising. And the issue is, the strike price will probably be at the next fundraising share price. So essentially you will work for up to 18 months before your upside is based on value creation post-Series A. In this case, make sure you negotiate a higher stake. Expect 0.50% up to 4.0%.

Caveat! If you really want to get more equity and maybe become a co-founder at this point (or what startups call Founding Team to differentiate from actual founders), you have two solutions, often intertwined:

1. Invest hard cash into the business, and

2. Accept a pay cut from your expected salary.

As such, you may get higher than 4% of capital all the way to 10% if the amount was substantial.

Results: Assuming a 1% stake and several further fundraising rounds, had you joined Facebook at that stage, you would own ~$244M at IPO. Had you joined Whatsapp at that stage, at its sale to Facebook, you would own ~$97M. Had you joined Instagram at that stage, at it sale to Facebook, you would own ~$4.9M. Had you joined Mint.com at that stage, at it sale to Intuit, you would own ~$830k.

4. Series A Scenario 🐤

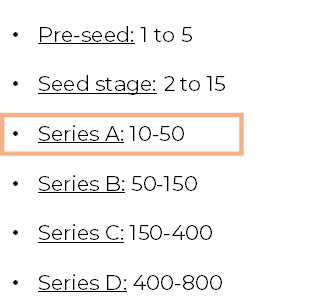

Now onto the Series A maths. By now the company has used the seed round to validate its product market fit. It has raised this latest round ($3M to $8M) to deploy a go to market strategy.

Let’s look again at the number of employees by round:

Startups will add anywhere from 20 to 40 employees during this round. As part of the fundraising, the company is expected issue up to 5% of stock options. Essentially, that means the company will be able to give 0.125% to 0.25% of its equity to new employees (again with exceptions for exceptional hires).

It’s assumed all companies issue a stock option pool during their series A. Therefore you shouldn’t find yourself in the position of joining and having to wait next round for stock options.

Results: Assuming a 0.1875% stake and one further fundraising round, had you joined Facebook at that stage, you would own ~$61M at IPO. Had you joined Whatsapp at that stage, at its sale to Facebook, you would own ~$24M. Had you joined Instagram at that stage, at it sale to Facebook, you would own ~$1.2M. Had you joined Mint.com at that stage, at it sale to Intuit, you would own ~$210k.

4. Series B Scenario 🐓

At this point, the company has used the Series A to validate a winning go to market strategy. Now the company needs to scale, face competitors, increase market share. The goal is not necessarily to become profitable although scale should help margins increase. There are the reasons why the company raised a Series B ($10M to $20M)

Let’s give a final look at the number of employees by round:

Startups will add approximately 100 employees during this round. As part of the Series B fundraising, the company should have again issued ~5% of stock options. Essentially that means the company will be able to give ~0.05% of its equity to new employees (like in all rounds, that number is subject to change depending on your seniority, experience, and need for your skillset).

Results: Assuming a 0.05% stake and no further fundraising rounds, had you joined Facebook at that stage, you would own ~$19M at IPO. Had you joined Whatsapp at that stage, at its sale to Facebook, you would own ~$7.5M. Had you joined Instagram at that stage, at it sale to Facebook, you would own ~$375k. Had you joined Mint.com at that stage, at it sale to Intuit, you would own ~$65k.

Now that you have an idea of what you could expect, here are a few strategies to validate your expectation:

- As simple as it may sound, just ask the HR manager the size of the stock option plan that was issued. Normally, the manager should tell you whether the pool was 3% or 10%.

- Once you have asked the size of the plan, ask the same manager what your collaborators at similar levels have received. Be subtle, don’t sound jealous, just ask for fairness. I would expect HR to give you the real number since the one-year cliff gives the company a lot of protection.

- Finally, ask around. Talk to a friend in another startup, in another VC, on Reddit (r/Entrepreneurship — has no posting restrictions if you don’t have any karma), or ask me (I answer every single message I receive, in due time).

Adapt your expectation accordingly from the informations you have gathered and give your equity number. Expect a negotiation downward therefore layer in some margin/cushion to your number.

Your feedback is priceless, feel free to ping us at anne-sophie@newfundcap.com.