Is Newfund useful?

With a massive slowdown of our inbound deal flow due to Covid-19, we decided to pause proactive investments for two months (apart from committed term sheets & hand shakes) and ask ourselves how we could be more useful to our founders?

Although this strategic evolution of being more than just a venture capital fund was initiated a few years ago, like Satya Nadella said about Microsoft, we believe we were able to do in 2 months what we had planned to achieve for all of 2020.

So let’s tell you a bit more on how we strive to be useful for our entrepreneurs. At the moment, our approach is three-pronged:

Operating Partners

Newfund now counts four full time operating partners dedicated to our startups.

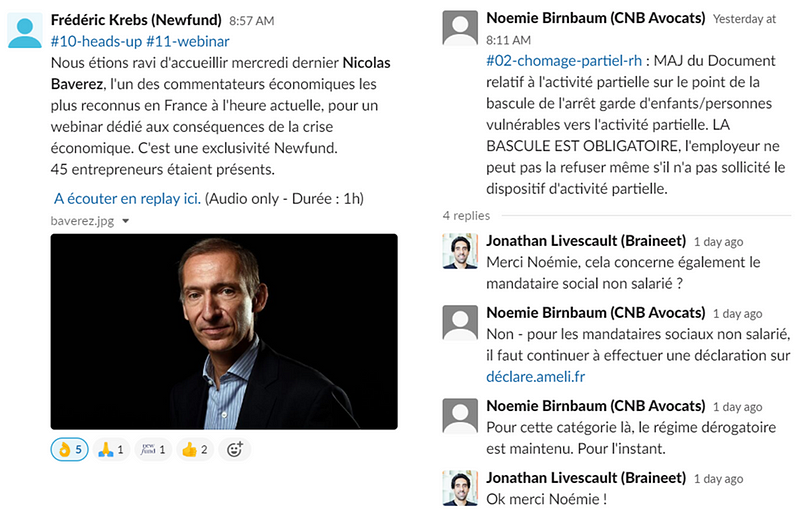

Fréderic Krebs: Former CEO of Allocine, spends his time on marketing and communication of our portfolio startups. Concrete example: knows how to find the right partner/agency; gives his own input from the most trivial questions like an adwords campaign to the more complex issues that keep founders up at night like pricing and product positioning.

Henri Deshays: Our US Partner but also our US expert. Said startup wants to move to the US: Henri will assess the likelihood of moving and accompany the startup through the different hoops of a transatlantic expansion. Henri will also help the company draft an equity story to increase chances of a successful follow-on fundraising round in the US.

Patrick Malka: Co-founder of Newfund and ex-auditor (EY), CFO & CEO of listed companies. Helps startups structure their growth, get the figures to pilot the company and build the management team.

Zoe Mohl: With a background in investment banking at JP Morgan San Francisco and strategy consulting working on due diligences in New York, Zoe is our strategy expert. She works around the clock to assist founders with any kind of transaction..

Each has their own area of expertise and is always available to help. But how do they remain up to date on the portfolio companies so as to avoid wasting entrepreneurs’ precious time?

Structured Reporting

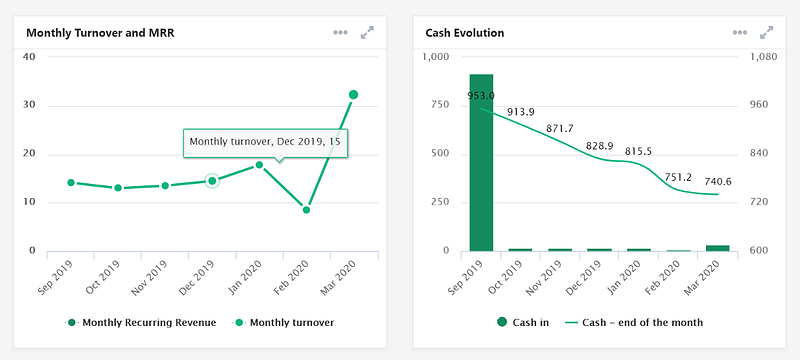

First, a few months ago, we implemented iLEVEL with our portfolio companies. This well-established tool among large cap private equity funds allows Newfund to collect accounting-level data from our startups on a monthly basis.

In 5 minutes, companies upload ~15 lines on an excel document with cash items such as revenues and itemized cost. This allows us to monitor extraordinary situations such as unusual cash burn, expenses or sharp increase/decrease of revenues. It complements the traditional monthly investor emails with data that we can utilize as their main seed investor.

iLEVEL has been immensely helpful in efficiently supporting all of our start-ups whilst treating them equally. The last thing we want is to squander our entrepreneurs’ time.

Now in order for the operating partners and investment directors to create direct lines with the founders, we have also developed our own communication tool.

Newfund Now

Newfund Now is a straightforward dedicated slack. The main difference is that we have included all Newfund team members (France and US), some of our LPs, all our entrepreneurs, and a few select outside experts on concrete subjects (such as labor laws). This creates a dynamic ecosystem where all stakeholders can chat together, ask experts, or create groups.

As opposed to a fixed website template where we list all sorts of resources, we made available to our startups select experts available 1–to–1.

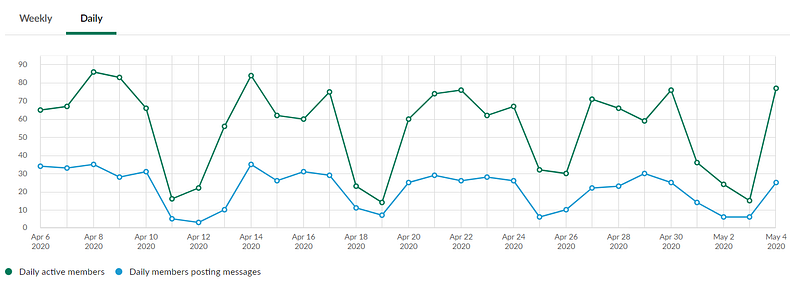

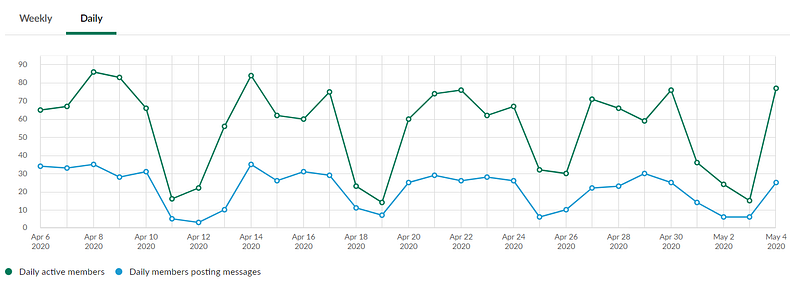

We have 55 startups on our slack, hence 110 entrepreneurs and 20 Newfund employees and experts. So far we are proud to see that close to 55% of the community connects on any day (DAU), and 75% on a weekly basis (WAU).

Venture Capital funds often give great advice to startups but are often criticized for not following them themselves. This crisis has given us the opportunity to apply to our own internal processes some of the same methodology used by startups.

Your feedback is priceless, feel free to ping us at vera@newfundcap.com.