Investing in the Next Newfund Fund : How Do I Determine My Commitment?

Unlike some investment mechanisms that immediately mobilize the subscribed amount, investing in private equity is gradual: the fund "calls" capital as it makes investments. Similarly, the fund distributes the proceeds from sales as they occur.

Newfund's experience demonstrates a certain regularity in these cash flows, in line with the investment management rules implemented by Newfund. This experience is what we share in this article.

To be specific, we have developed a simple tool to simulate the main financial flows related to a typical Newfund fund: capital calls, distributions, and net flows combining calls and distributions. You can directly test our simple simulation tool through the link below.

Past performance is not indicative of future results.

Gradual Capital Deployment

At Newfund, we rigorously select investments. Maximizing the pace of capital deployment is not our objective.

By investing in a Newfund fund, the subscriber (the Limited Partner or "LP") commits to releasing between 10% and 15% of the total subscription amount each year during the investment period. For our Newfund1 and Newfund2 funds, we have never called funds for more than 15% of the subscribed amounts over a period of 12 consecutive months.

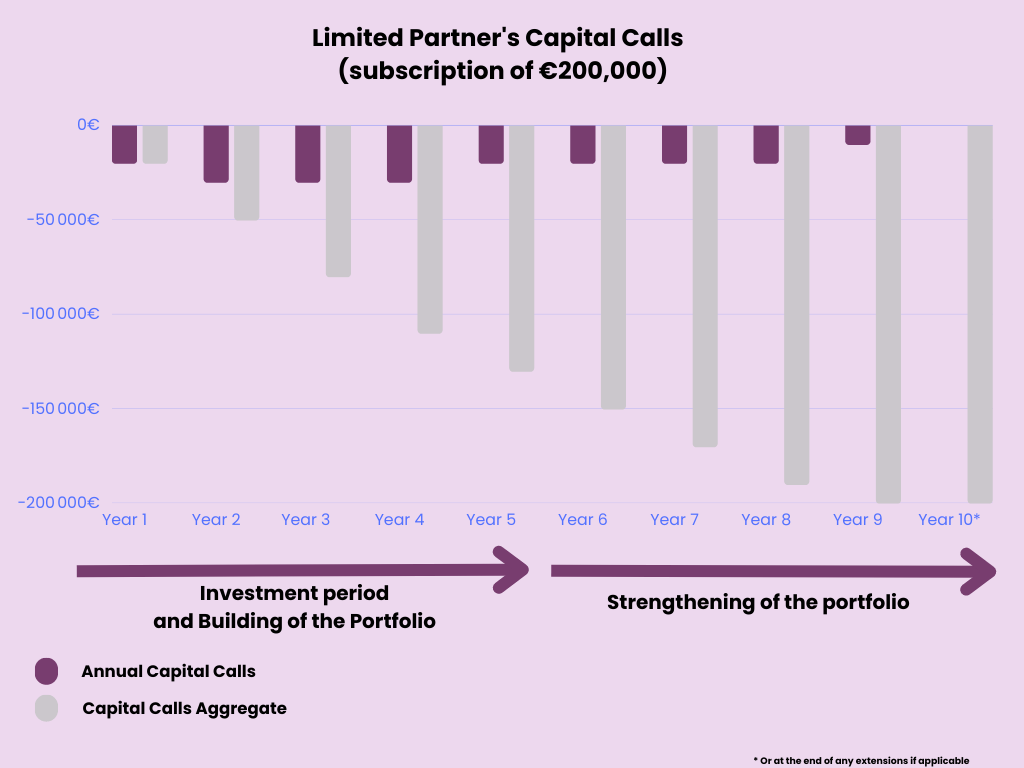

Regarding capital calls, the fund's life is divided into two periods:

- The first is the investment period, which lasts five years and involves building the portfolio of holdings.

- During the second part of the fund's life, investments are limited to the existing portfolio. Capital calls during this phase are therefore focused on portfolio reinforcement rather than new startup investments. Consequently, capital calls are smaller during this second phase than during the first.

For a typical fund at Newfund, let's take the example of a €200,000 subscription. This means that the capital called each year will be between €20,000 and €30,000 over the first five years.

The amounts called for this fund will be 5% per capital call, which amounts to €10,000 for our €200,000 subscriber. There will be two or three capital calls per year, depending on the quality of opportunities identified by the investment team.

Newfund is proud to have 95% of individuals among its LPs who commit their personal fortunes. This consistent community also pays attention to the progressive and rational construction of the portfolio of holdings.

To illustrate, capital calls can follow the following curve (for a €200,000 subscription) :

First Exits Occur After 5 Years

Investing in innovation capital goes beyond providing capital: it is an active partnership where the investor supports the funded companies strategically and operationally. On a day-to-day basis, this support materializes through the assistance of our "Operating Partners" and the application of our proven methods honed over fifteen years.

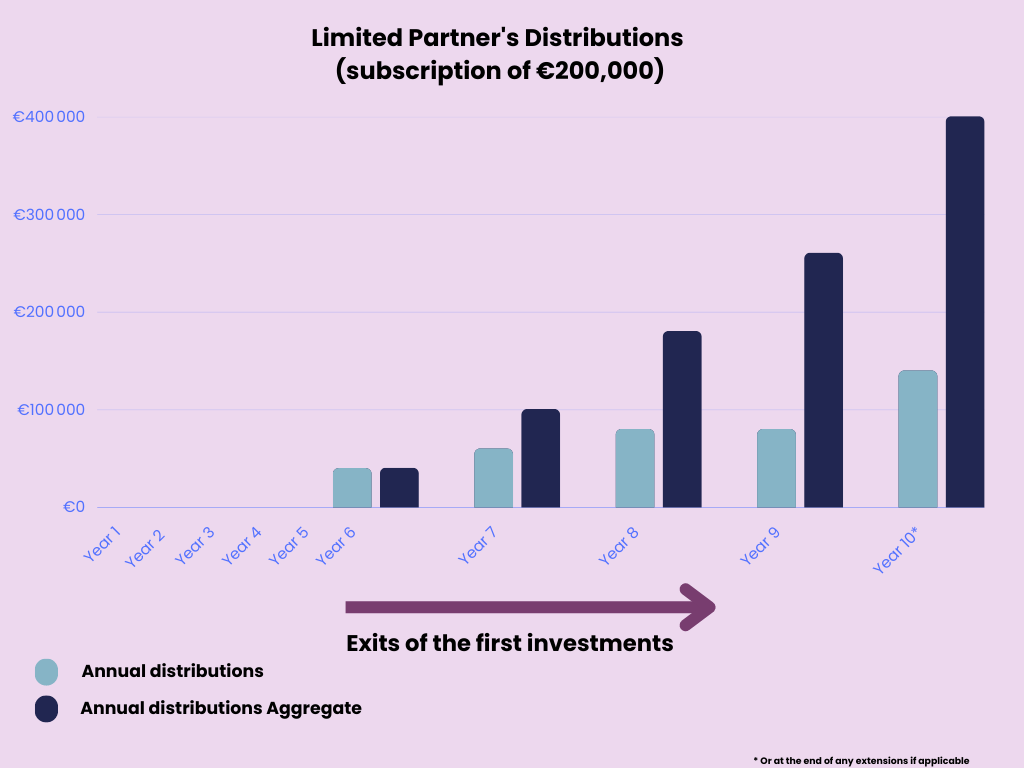

When value creation is rapid or due to market opportunities, the first exits can occur as early as year 5 or 6 of the fund's life. Often, it is the entrepreneurs who initiate the transaction. For example, in the case of Newfund1 (2009 vintage), Medtech SA was sold in 2016. For Newfund2 (2016 vintage), Kiute, DejaMobile, and Young Alfred were sold in 2021, and Eqinov was sold in 2022.

When holdings are sold, the proceeds are distributed to subscribers promptly. For individuals residing in France who have opted for the favorable tax regime, the distribution will need to wait until the fifth anniversary of the subscription. In return, the French subscriber will not be subject to income tax, and the fund's capital gains, which is the amount distributed once the subscriber has been fully reimbursed for their investment, will only be subject to social security contributions.

Schematically, distribution flows can take the following form (still based on a €200,000 subscription) :

Initial Distributions Fund Capital Calls Starting in Year 5, Limiting Effective Investment.

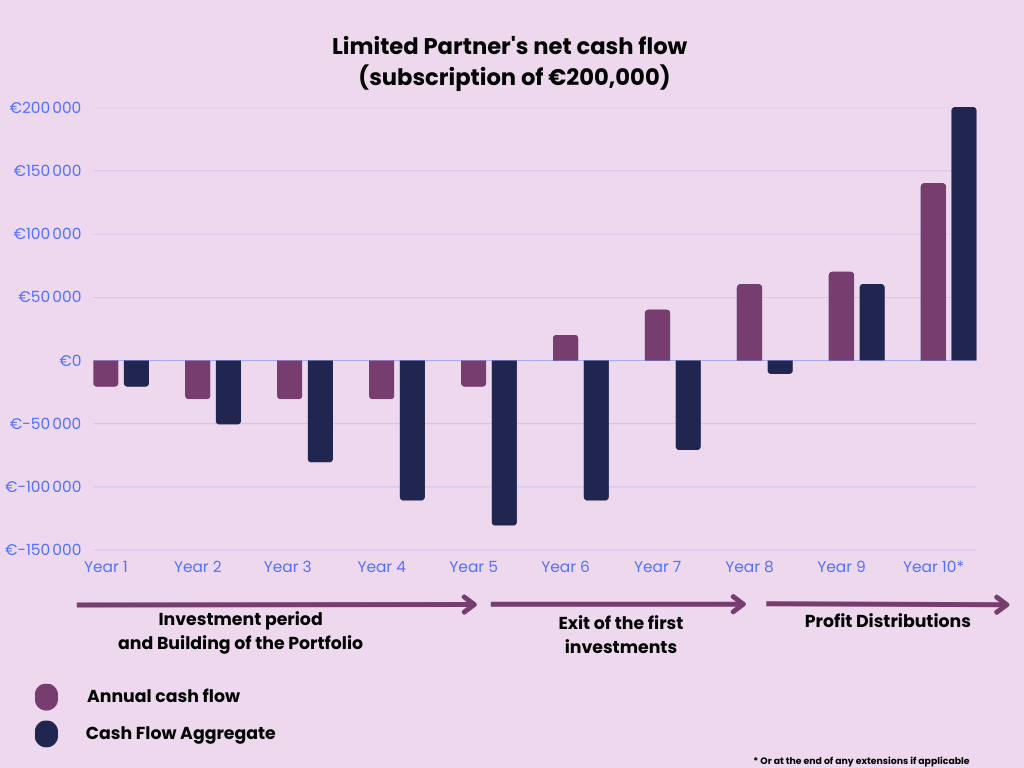

This is the "magic of private equity": distributions offset capital calls from the second phase of the fund's life, and the distributed amounts increase as the portfolio matures. This mechanism, which is fundamental in Newfund's fund management, significantly reduces the subscriber's cash commitment.

For Newfund 1 and 2, subscribers had a maximum cash exposure equivalent to 65% of the subscribed amount. The remaining 35% was called when the first distributions took place.

In summary, if we combine the outflows from capital calls and the inflows from distributions (graphs 1 and 2 above), the combined flows are as follows :

In total, for a €200,000 subscription, the subscriber has made a "hard" investment of €130,000, at a rate of €20,000 to €30,000 per year over the first five years. From year 6 onwards, they begin to receive positive cash flows.

If we calculate the investment made as a fixed amount over the first 8 years, it would be €72,500.

In year 9, our subscriber enters a capital gain position, ultimately ending the fund's life with €400,000.

This capital represents a 2x return on the total subscribed and called amount, a 3.1x return on the maximum cash exposure, and a 5.5x return on the average amount invested during the first eight years.

To help you better calculate the subscription amount that best suits your financial situation, we have designed a simple simulation tool, our "VC Calculator", accessible through the link below.

Your feedback is valuable. We would be delighted to hear your opinions and suggestions at : francois@newfundcap.com;