Global Braintech Funding: Key Trends and Insights, 2023-2025

This report maps how capital has been allocated from 2023 to 2025, as BrainTech is a core vertical of Newfund’s health strategy with Heka.

This report maps how capital has been allocated from 2023 to 2025* by geography, stage, pathology and technology, as BrainTech is a core vertical of Newfund’s health and deep-tech strategy, with Heka as its dedicated fund focused on brain health, cognition and mental health.

*2025 : end of October

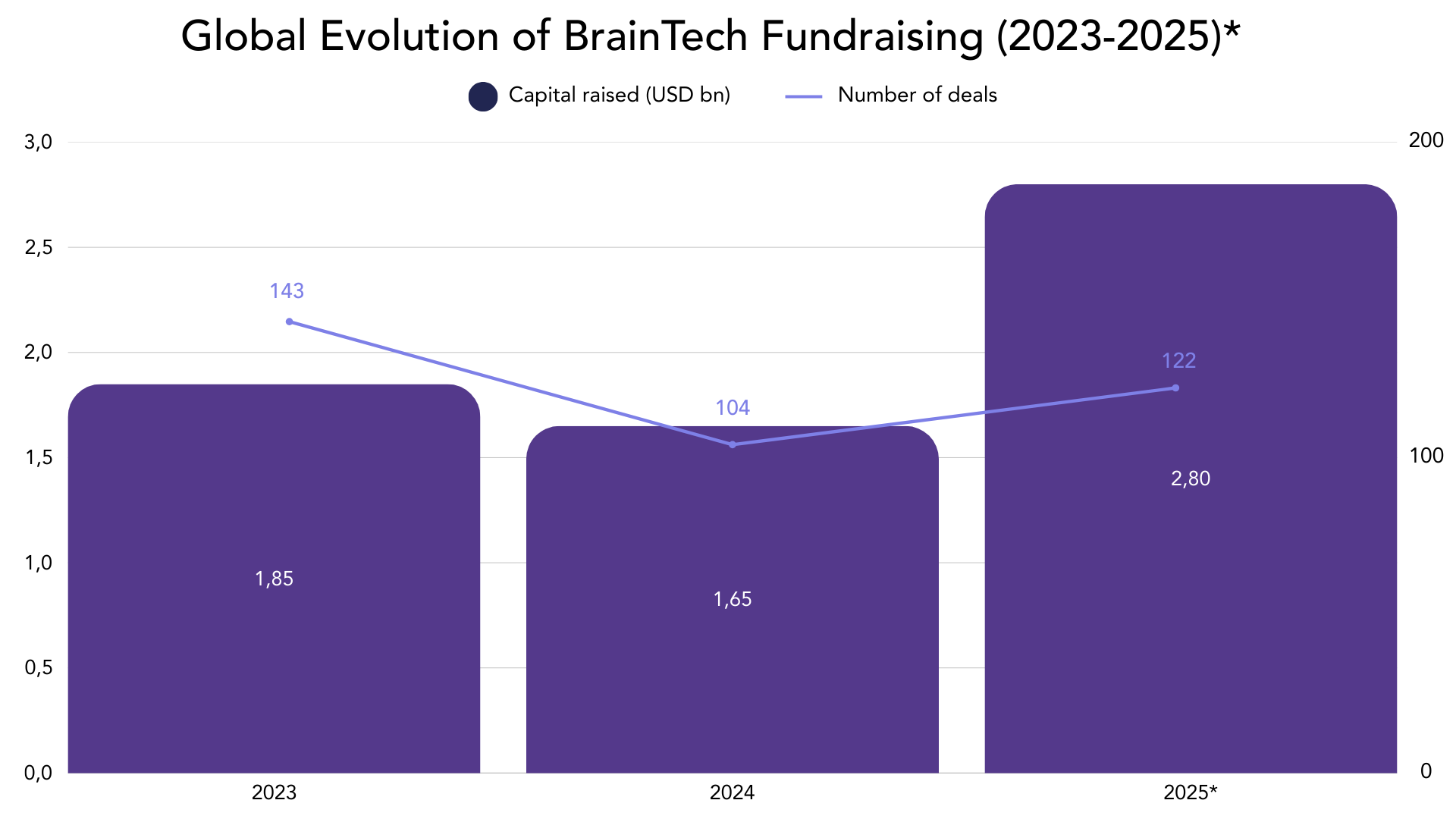

Global Evolution of Braintech Fundraising (2023–2025)

After a slowdown in 2024, the Braintech market shows a clear rebound in 2025, surpassing even 2023 levels. The number of deals dropped by around 30% between 2023 and 2024, while total amounts remained almost stable, indicating an increase in the average ticket size. In 2025, the amounts raised increase by roughly 55% compared with 2024, despite a similar number of deals. This suggests a strong concentration of capital into larger rounds.

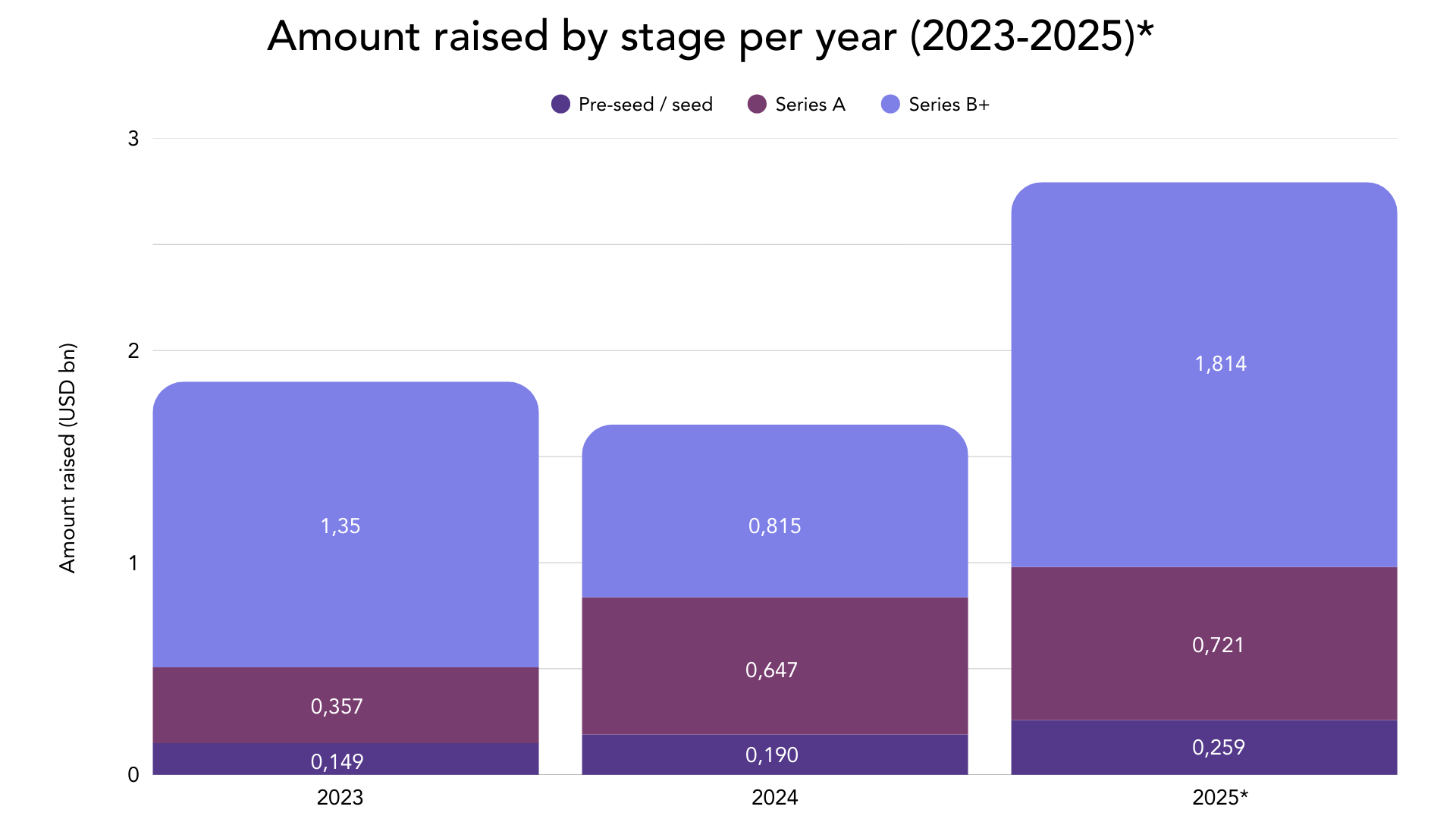

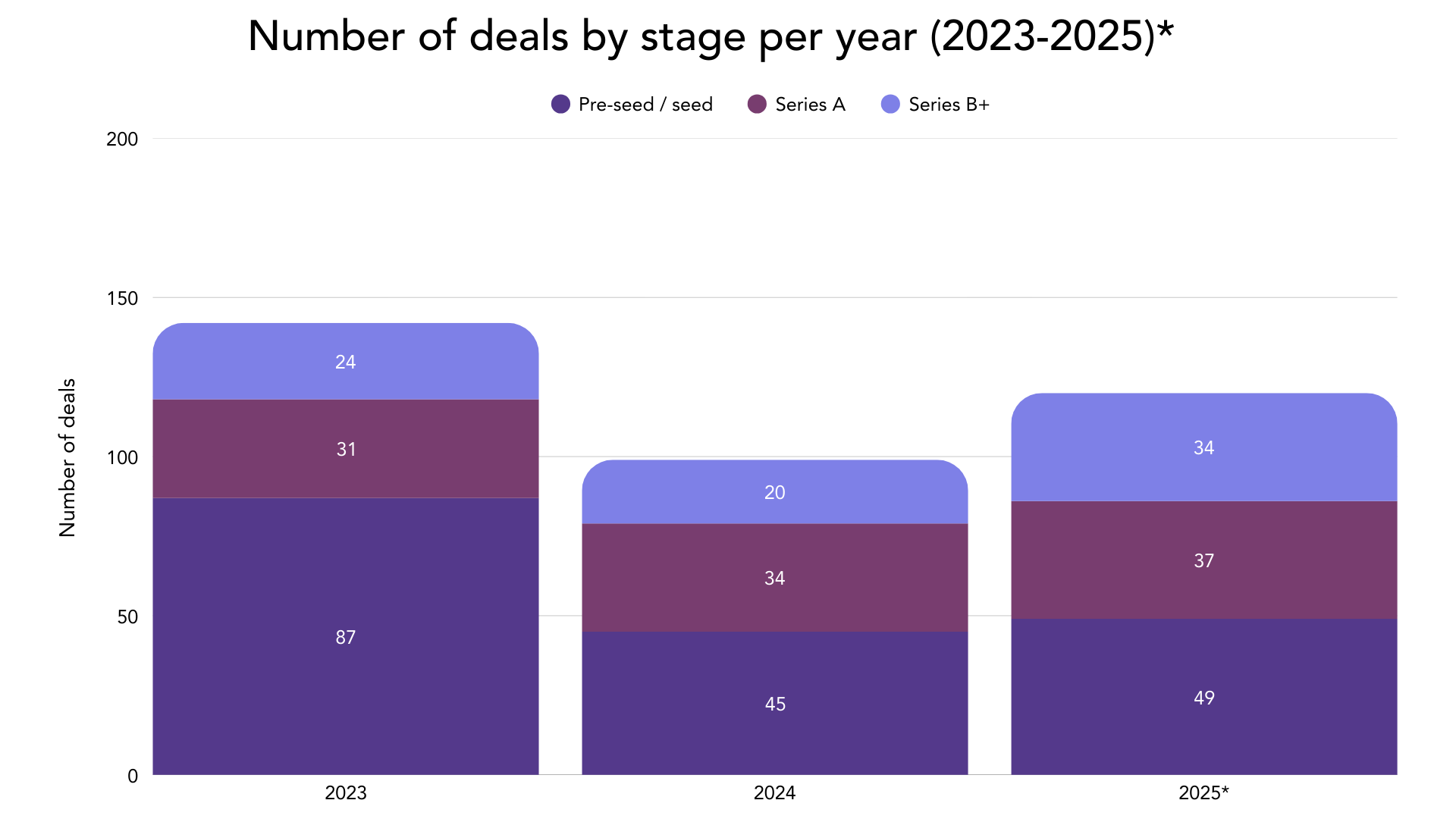

Breakdown by Stage of Maturity

In terms of number of deals, the market remains largely oriented toward early-stage rounds (Pre-seed, Seed, and Series A), although the share of Series B+ is increasing.In terms of amounts raised, later-stage rounds (Series B+) already capture the majority of capital and further strengthen their weight after 2024.

As the Braintech market gradually structures itself, it is becoming more mature and is beginning to show its first signs of success. Its profile increasingly mirrors digital health: a broad base of early-stage experimentation, but capital concentrated in a smaller set of later-stage, scaling companies.

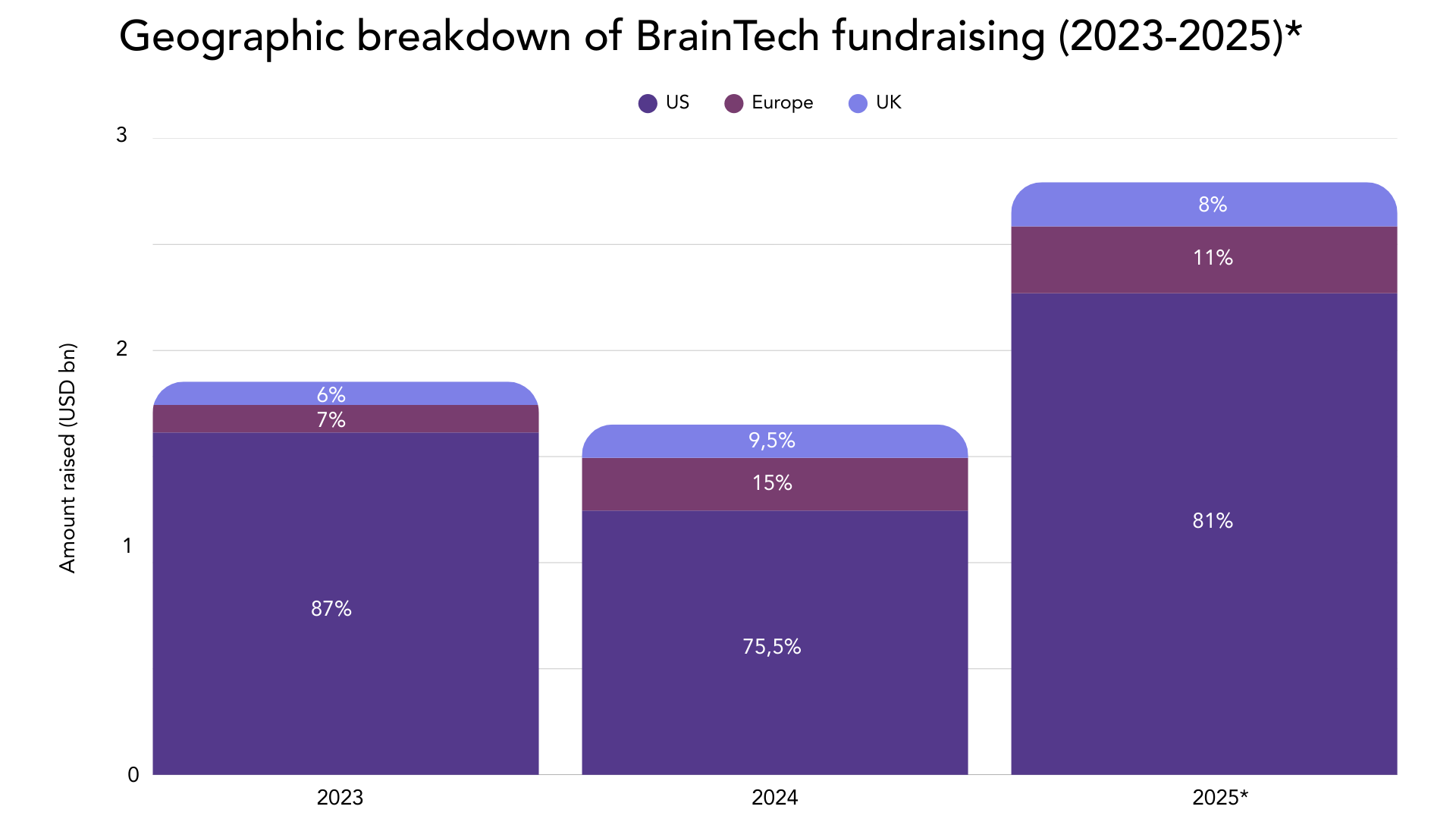

Geographic Breakdown of Fundraising in BrainTech

The United States remains the clear center of gravity for Braintech, with investors increasingly concentrating capital there. Over the 2023–2025 period, total disclosed funding reached approximately $6.3 billion, of which the US alone accounts for about $5.1 billion. This dominance reinforces the relevance of a US-oriented strategy for European companies seeking scale.

Europe also maintains solid momentum. The UK attracted roughly $475 million, while the EU (excluding the UK) reached around $690 million, indicating a gradual improvement in the region’s attractiveness despite its smaller size.

Overall, the global market continues to be shaped primarily by American players, while Europe consolidates its position as a secondary but strengthening hub.

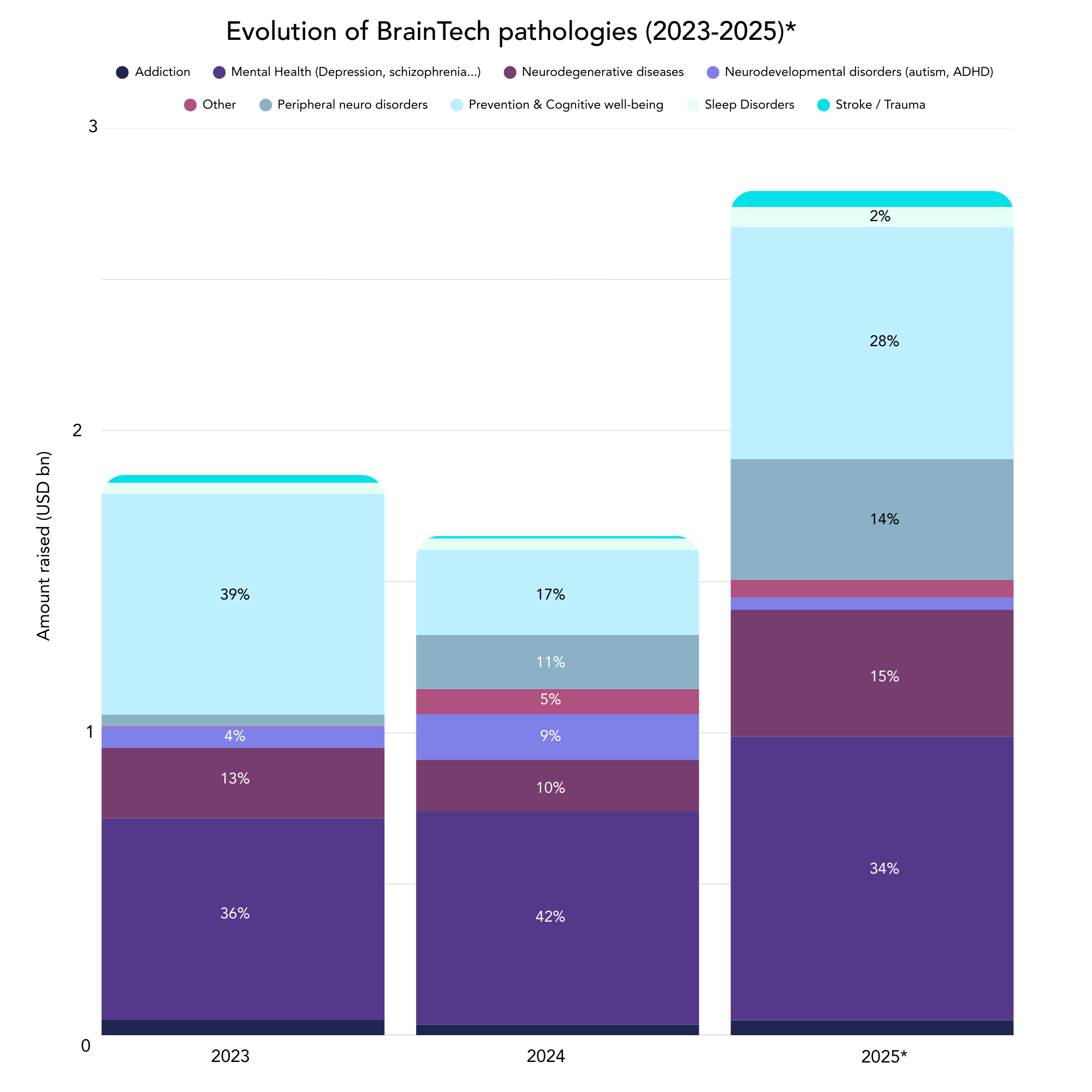

Investment Breakdown by Segments : pathologies and modalities used

Mental health remains the dominant segment in terms of capital invested, continuing to anchor the market. Over the full 2023–2025 period, it represents roughly $2.3 billion in funding. Within this category, women’s brain health begins to appear more visibly in 2025, accounting for around 7% of mental-health-related deals, even though it does not appear explicitly in the chart.

Beyond this core, several segments are gaining real traction.

Prevention and cognitive well-being show a strong rise across the period, with total funding reaching approximately $1.8 billion. The shift becomes particularly clear in 2025, as more capital flows into solutions focused on early intervention, cognitive support and long-term brain-health monitoring.

Neurodegenerative diseases also gain momentum, though in a more gradual way. Total funding amounts to around $820 million, with growth driven mainly by larger late-stage rounds rather than broad expansion of the segment, a pattern more indicative of consolidation than acceleration.

Peripheral neuro disorders are now forming a distinct new axis. The category reaches about $615 million in cumulative funding, with a visible spike in 2024 driven by urinary-incontinence solutions. Although these conditions are not primary brain pathologies, they are tightly linked to the nervous system, as bladder control depends on neural signalling between the brain, spinal cord and peripheral nerves. As neuromodulation technologies mature, they increasingly offer effective therapeutic options for a wider range of such disorders. The segment expands further in 2025, with activity rising both in value and volume.

Overall, while the market remains centered on mental health, the funding landscape is clearly diversifying. Capital is progressively shifting toward neurodegeneration, emerging preventive approaches, and a growing cluster of peripheral neurological disorders that are beginning to form a meaningful third pillar of the Braintech ecosystem.

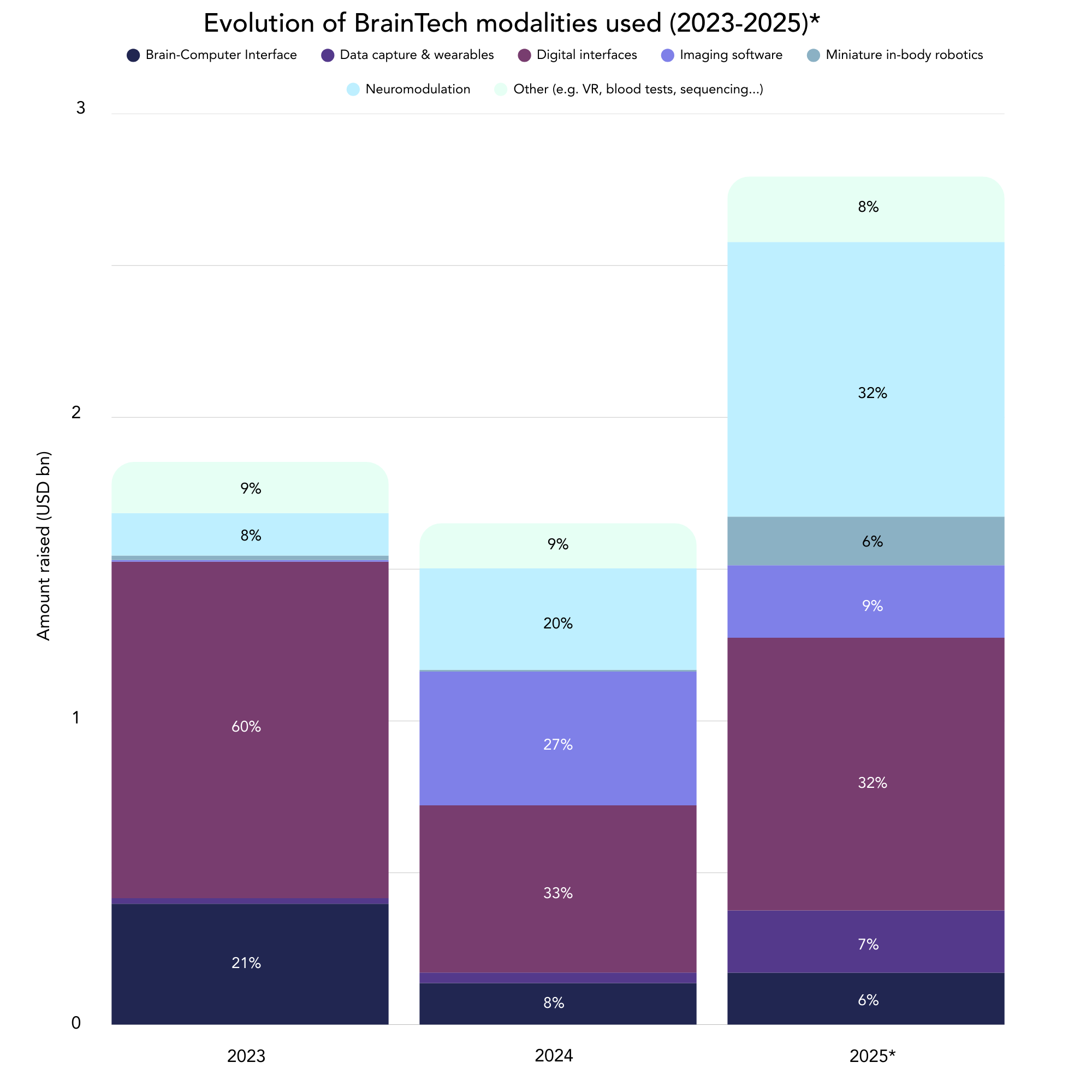

Digital interfaces remain the dominant modalities across Braintech, especially in mental health, where around 80% of solutions rely on app- or web-based interfaces. Over the 2023-2025 period, they represent approximately $2.6 billion in funding. In practice, these solutions are mostly B2C platforms focused on matching users with clinicians, providing coaching or structured follow-up, and building support communities.

Neuromodulation, defined as therapeutic stimulation of neural circuits (electrical, magnetic, ultrasound), becomes the main emerging technology. It reaches around $1.4 billion over the period, with its share of funding growing strongly between 2023 and 2025 and spreading across pain, migraine and neurodegeneration.

Brain-computer interfaces, by contrast, are defined by their ability to decode brain signals or transmit them to external devices. Some BCI systems can also deliver stimulation, but their core role is to capture and translate neural information for communication, control or monitoring. In this mapping, they are therefore tracked separately from neuromodulation, which is more squarely focused on care delivery. BCIs accumulate roughly $706 million between 2023 and 2025. Funding peaks in 2023 and then declines, suggesting a shift away from early infrastructure-type bets toward more near-term clinical applications such as neuromodulation and imaging software.

Imaging softwares continue to gain traction, particularly in 2024, and total around $684 million in cumulative funding. They are increasingly used for cognitive prevention and early detection, reinforcing their cross-cutting role in the ecosystem.

Overall, the picture moves from a landscape dominated by pure software platforms to a more technological mix where traditional medtech and tech converge, and capital increasingly backs neuromodulation, imaging softwares and advanced neuro devices rather than standalone Brain-Computer Interface plays. In parallel, AI is now embedded in a growing share of these solutions, from diagnostics and imaging to neuromodulation and digital interfaces, further accelerating this convergence.

General conclusions

- Temporal dynamics: After a clear slowdown in 2024, both in deal count and total capital, the Braintech market rebounds sharply in 2025. Despite partial data, 2025 already exceeds 2023 in total amounts raised, driven by the US and by larger late-stage rounds.

- Maturity: In number of deals, the market remains heavily early-stage (Pre-seed / Seed / Series A). In capital, however, Series B+ now capture the majority of funding and accelerate strongly in 2025. This reflects a sector that is maturing, with capital increasingly flowing to more established players and larger tickets.

- Pathology segments: Mental health remains the main funded category, and women’s brain health emerges within this block in 2025. Budgets are gradually shifting beyond mental health: neurodegenerative diseases gain weight in total capital, and peripheral neurological disorders now form a clear third axis, with a noticeable spike in 2024 followed by further growth in 2025.

- Technological modalities: Digital interfaces remain the dominant modality, representing around 80% of mental-health-related solutions. Neuromodulation, understood as therapeutic stimulation of neural circuits, is becoming a major emerging pillar and expands across multiple indications (neurodegeneration, pain, migraine, UUI, women’s health). Brain-Computer Interfaces are, instead, defined by their ability to decode brain signals and transmit them to external systems; some of these solutions can also deliver stimulation, but their primary role is to capture and translate neural information. Imaging software is also gaining traction, especially within prevention and early-diagnosis applications. In contrast, Brain-Computer Interfaces peak in 2023 and then decline, as capital shifts toward more clinically driven technologies. Meanwhile, AI is now embedded across a growing share of projects, illustrating a strong convergence between traditional medtech and tech.

Overall, Braintech is moving from an exploratory phase dominated by pure software platforms to a consolidation phase: a maturing global ecosystem, still led by the US, where capital increasingly flows toward later-stage rounds, newly emerging pathology areas (neurodegeneration, peripheral disorders), and a more technological, multimodal mix combining AI, neuromodulation, imaging and advanced neuro devices.

Method used for this report

This report draws on funding data for Braintech companies in Europe and the US over the past three years. The dataset is built from a combination of sources: ongoing monitoring of specialist newsletters (including The Transmitter, MobiHealthNews, Rock Health, Healthcare Brew, Health Tech Nerds, Dealroom, StartUp Health, Where Tech Meets Bio, Decoding Bio, Femtech Insider, Asimov Press, Baby VC, among others) and curated content shared by individual experts (such as Steve Duke on LinkedIn). These qualitative sources are complemented by funding databases (including Crunchbase), public announcements (press releases, blogs, company websites) and Newfund’s internal CRM for companies directly monitored by the team.

The analysis includes rounds announced between January 2023 and October 2025. Data for 2025 are therefore partial and should be interpreted as a lower bound rather than a full-year total.

Pure biotech and pharma plays are excluded from the analysis, particularly companies whose core activity is drug discovery or molecule development.

For each funding round, both the company (segment, product type, underlying technology, geography) and the deal (stage, amount, date) are classified. Whenever possible, funding amounts and stages are cross-checked across at least two independent sources. Amounts refer to equity or quasi-equity raised in a specific round and generally exclude grants and other forms of non-dilutive financing.

Definitions

- Braintech: digital health, medtech and neurotech solutions focused on mental health, cognition, and central or peripheral nervous system conditions, excluding biotech companies primarily developing drugs.

- Early stage: Pre-Seed, Seed and Series A rounds.

- Late stage / Series B+: Series B and all subsequent equity funding rounds.

- Digital interfaces: app- or web-based platforms delivering assessment, monitoring, coaching, therapeutic content, teleconsultations or care coordination, with or without hardware components.

- Neuromodulation: technologies that deliver therapeutic stimulation (electrical, magnetic, ultrasound or other energy forms) to neural circuits with the primary aim of treating symptoms or modifying neural activity.

- Brain-Computer Interfaces (BCIs): systems designed to decode or transmit brain signals to external devices for communication, control or monitoring. Some BCI solutions can also deliver stimulation, but their core function is to capture and translate neural information.

- Imaging software: software layers that process brain or nervous-system–related signals (e.g. MRI, EEG, functional imaging or equivalent biosignals) to support diagnosis, monitoring or risk stratification.

- Women’s brain health: solutions that specifically address how female-specific factors (such as hormonal cycles, contraception, pregnancy, postpartum or menopause) affect mood, cognition and neurological symptoms.

*2025 : end of October