The collapsing French fundraising market and the AI hope: Time to invest or time to wait?

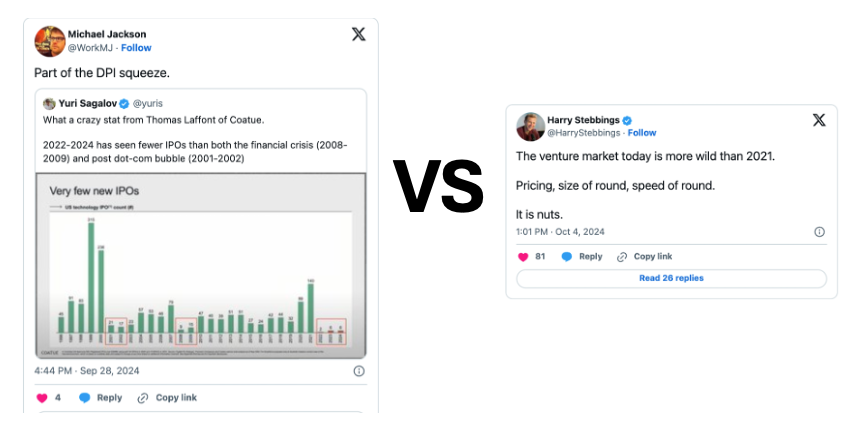

I’ve been struggling for months to understand what’s happening in the venture market. It feels like we’re in both the coldest and hottest fundraising markets ever, simultaneously.

Here’s what we know: the liquidity crisis is severe, with fewer IPOs and exits than we saw even during the dot-com bubble or the subprime crisis. Fund managers are struggling to raise new funds, valuations are dropping, startups are failing at unprecedented rates, and LPs are pulling out of a disappointing asset class due to underwhelming liquidity and returns. Yet, somehow, the venture market is also unusually hot, wilder than 2021, with entrepreneurs raising mega rounds at unicorn valuations pre product and pre revenue.

What’s driving this contradiction? To understand, we need to return to the essence of what venture capital is: people betting on other people. While AI might eventually handle VC investing in the near future, for now, it’s still humans making the calls — humans who bring cognitive biases, irrational optimism, irrational pessimism, and with their hidden agendas. These conflicting forces are shaping the market’s behavior.

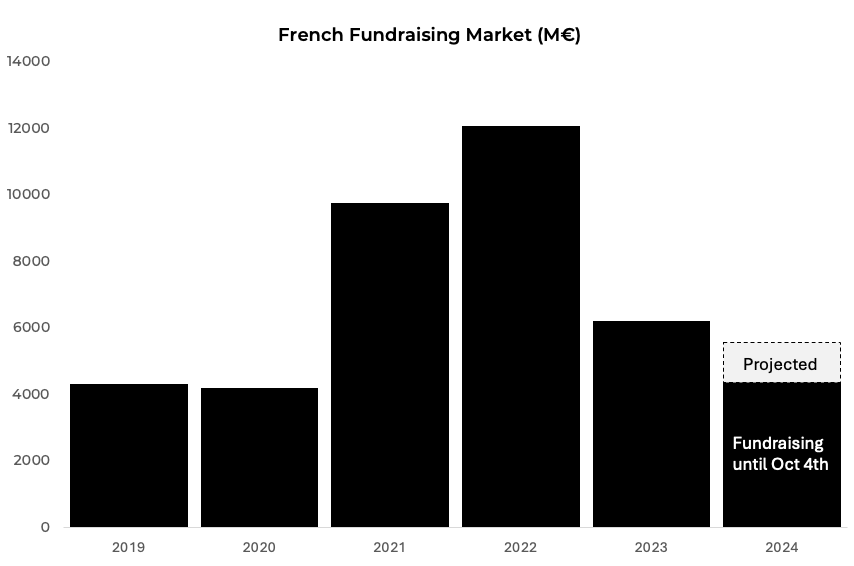

My 2023 guess for 2024 was that the fundraising market would collapse, but it is actually holding steady, for the moment…

Negative macroeconomic conditions combined with investor pessimism during crises usually lead to market collapses (see negative spiral below).

Yet, looking at the French fundraising market, the full reset hasn’t materialized — at least, not yet. While many U.S. funds have exited the French tech scene post-2021/2022, the contraction in fundraising seems to have stabilized. Projections for 2024 show only a slight dip (down 10% as of October vs. the same period in 2023), but not the expected freefall.

Why hasn’t the market fully reset (yet)?

To understand why the market hasn’t crashed, let’s examine the forces shaping investor behavior:

1. VCs still have capital they’re pressured to deploy

VCs still have cash to deploy from funds raised during the 2019–2022 boom, typically with 5–7-year investment periods. Maintaining a strong capital deployment velocity is crucial for future fundraising. Many VCs prefer investing in suboptimal conditions over not investing at all, as staying active in the market is essential to secure their next fund.

2. Competition for high-quality deals inflates rounds

As capital needs to be deployed, fierce competition for top-quality deals inflates both funding rounds and valuations. With fewer high-quality startups, funds are competing aggressively, often driving funding rounds and valuations up.

3. Young Partners’ ambitions fuel aggressive investing

VCs raised a lot of money when the market was hot and recruited a lot of young partners to deploy it, and young partners are eager to build their track records quickly. Waiting one or two years for market conditions to improve is not an option. They want notable “shiny logos” in their portfolios to advance their careers, creating pressure on General Partners to continue investing.

4. There is optimism about a rebound

Some investors believe the market will eventually bounce back — interest rates will drop, the IPO window will reopen, and M&A will come back again. When that happens, there will be fewer well-financed startups to acquire, pushing M&A prices back up. So, investing in the best startups today will pay off tomorrow.

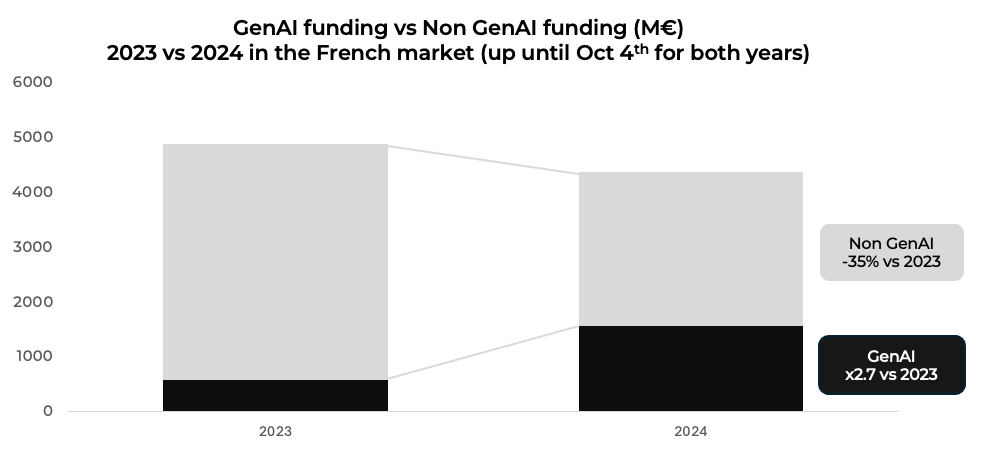

In reality, the market is seriously contracting, but it is being offset by a new phenomenon: GenAI

There are actually two venture markets at the moment: the “traditional” venture market, which is shrinking (down 35% compared to 2023), and the GenAI market, which is soaring (up 2.7x from last year), bringing US funds back to France, but only for this category.

Once again, let’s examine the forces behind investor behavior to understand what’s fueling AI enthusiasm:

1. FOMO (fear of missing out) on the next big thing

The very essence of venture capital is to invest in outliers — founders and companies that can deliver returns > 50x. VCs don’t want to miss out on the once-in-a-lifetime opportunity to fund the global champions of a new category, no matter the cost. Even if valuations are sky-high or if we are in the midst of a speculative bubble. If you had invested in Amazon at the peak of the dot-com bubble, it might seem irrational at the time, but today, you’d still be sitting on a 50x return.

2. France’s reputation for AI talent attracts global investors

France is internationally recognized for its AI talent. Yann LeCun, pioneer of deep learning, is French. Among the 14 engineers behind Meta’s LLama (the LLM), 11 are French. The founders of HuggingFace? They are French too. So when a French engineer who graduated from Ecole Polytechnique or ENS and with experience at OpenAI or Deepmind starts a new venture, it sparks a lot of interest and competition from investors globally, driving the funding rounds and valuations up.

3. Building AI models is expensive, and VCs want to deploy capital quickly: it is a perfect match

Creating leading AI models requires vast resources — from computing power to specialized talent — which pushes funding needs sky-high. As a result, early-stage AI companies are raising larger rounds to cover these costs, allowing VCs to deploy capital quickly.

4. GenAI isn’t just a new category, it is the ultimate category and it changes everything

Some investors view the rise of GenAI not as just another tech wave like software, cloud, or mobile, but as the ultimate category — the greatest invention in human history and possibly the last one we’ll ever shape. AI will be capable of solving humanity’s biggest problems and creating tomorrow’s innovations on its own and across all fields and industries. This infinite potential fuels incredible excitement, even if the business models of most GenAI startups are still unproven. And where there’s FOMO, there are large funding rounds and inflated valuations…

5. U.S. Funds are back in France for GenAI, and they don’t care about how much it costs

Major U.S. funds have returned to France to fund AI, bringing much deeper pockets than their European counterparts. For them, a €100 million investment is minimal — an option to secure a stake in the next wave of tech leaders.

Investing in AI in current market conditions: is it worth the gamble?

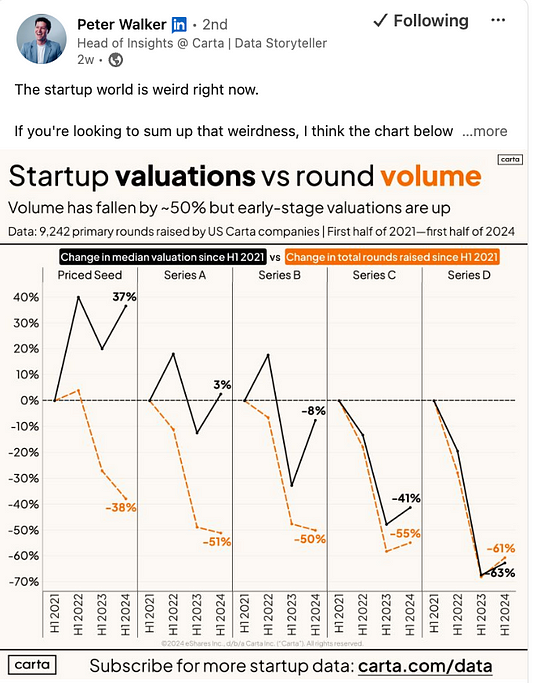

The AI surge has disrupted valuations, reducing the gap between early-stage and late-stage valuations. Seed-stage valuations are soaring (driven by FOMO), while late-stage valuations are falling (driven by bad market conditions), creating a strange and unsustainable market dislocation. Should early stage investors accept these high valuations to avoid missing out, or wait for the hype to cool?

One thing is certain: with current valuation levels at Seed stage, there will be more losers than winners among VCs. Who will win? The luckiest? The more knowledgeable? Those with the best deal flow? Or those who diversify their GenAI bets to maximize their odds of backing a future giant, even if valuations are irrational?

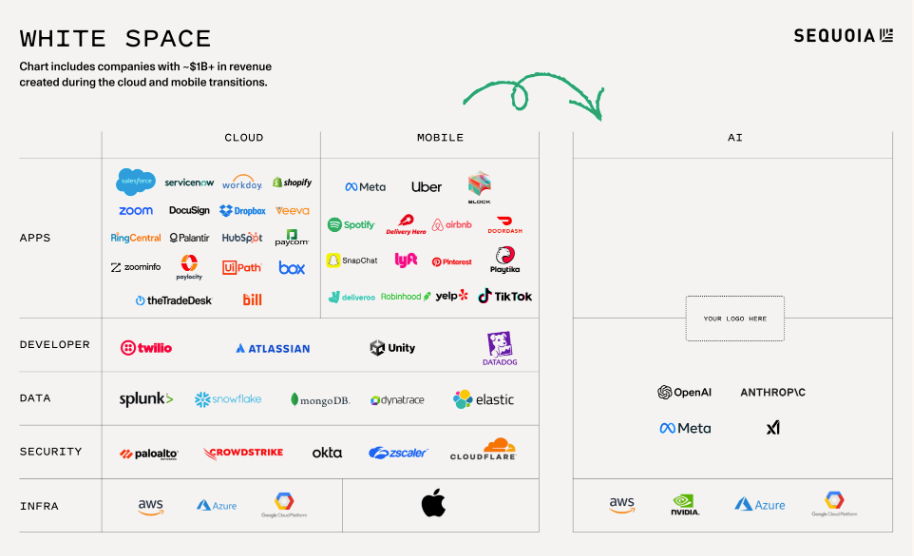

An insightful article from Sequoia, “Generative AI’s Act 1,” argues that the GenAI "category" will produce 35 major champions, each potentially generating over €1 billion in revenue. 35 vs thousands of GenAI startups to be funded in the next few years. That is the game GenAI investors are playing.

Conclusion: time to invest or time to wait?

My personal prediction for 2025 is that the fundraising market will continue to decline. Funds are overall struggling to raise new capital and will eventually have less money to invest, leading to a decrease in early stage valuations and the end of the market dislocation, despite the AI hype. As an early stage investor, in theory, maybe I should wait for better market conditions. But I am often wrong and waiting is hard, especially when you are a young investor building its track record during the most exciting innovation breakthrough in human history.