A data-driven approach to an early US expansion

Newfund Capital invests and supports early stage France-based startups in their US expansion. We strongly believe that such an early international expansion comes with great benefits for the product, the team, the future financings, and finally the liquidity for all. Recently two of our landmark investments have made headlines, Aircall and Nfinite, but we wanted to reinforce our vision with a more data-driven approach.

We conducted an analysis on a shortlist of French scaleups with activities in the US, compared them to scaleups without any activity in the US. Here is what we found.

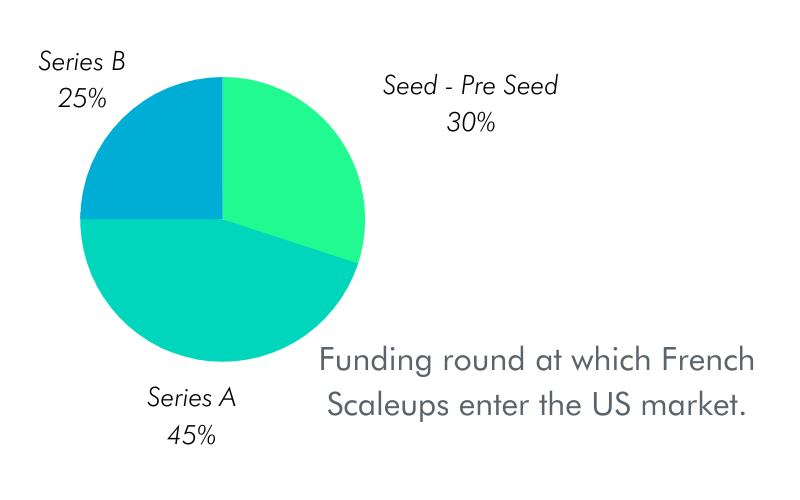

1. Three quarters of French scaleups active in the US have entered the country before their Series B:

- 30% have entered the US market right after their Pre-seed or Seed, and 45% after their Series A and 25% after their Series B.

- On average, it took slightly more than 4 years after incorporating in France for the French scaleups to incorporate in the US.

2. French scaleups often get quick fundraising after their US entry:

- 65% raised less than 1 year after their entry in the US.

- As expected from point 1, 62% of these quick fundraisings were Series B, 15% Series A and 15% Series C.

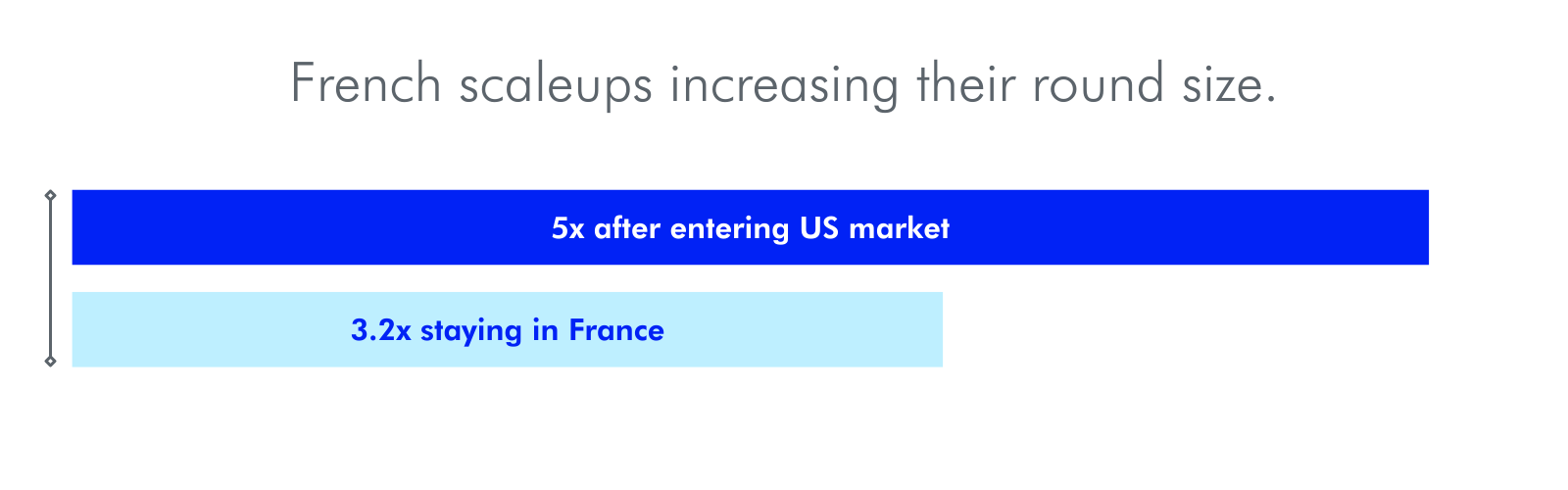

3. French scaleups which entered the US market raise more than their France only-focused peers

- After entering the US market, French scaleups have increased their round sizes by 5x. This compares to 3.2x for three France only-focused scaleups.

- After entering the US market, French scaleups have increased their total amount raised by $20M. This compares to $15M for three France only-focused scaleups.

4. American funds rarely finance the US market entry of French scaleups. They tend to express interest once the scaleups have proven their capacity to succeed in the US:

- Only 28% of French scaleups had an American fund onboarded before their US incorporation.

- Almost 40% of French scaleups had their first American fund joining at Series C, and just 22% at Series B.

5. However, American funds play a major role in the US expansion of French scaleups:

- The overwhelming majority end up raising from at least one American fund (90%) and 50% have more than 3 American funds in their equity story.

- French scaleups have benefited from the diversity of the investment ecosystem in the US. Indeed, more than 50 different investment funds are shareholders in at least one of the 20 scaleups of our list.

- Some American funds are particularly active. For instance, Goldman Sachs has invested in 6 of them, and Accel in 3 of them.

6. Expanding to the US does not necessarily require flipping:

- Only 25% have an HQ in the US.

- Only 30% have a founder located in the US.

- The proportion of employees located in the US represent on average 17% of the scaleups’ total employees.

Scaleups significantly benefit from expanding to the US in their early stages. They obtain quicker and larger fundraisings than their France only-focused peers, yet only if they show they can successfully expand their activities to the US. So the earlier, the better.

Lastly, as the sanitary crisis has removed barriers to commercializing digital products cross-border, we expect that French startups will increasingly enter the US market earlier than ever before.

Methodology:

Our methodology included 2 steps:

First, we identified 60 French scaleups with US activities. We shortlisted 20 which seemed to be the most appropriate ones for our analysis taking into account their size, age and US activities. The scaleups which were incorporated in the US before France were removed to avoid potential bias.

Second, we sourced and gathered relevant data on their incorporation dates in France and in the US, HQ, raising amounts and dates, participating funds, and recruitment.

In parallel, we sourced and gathered similar information for 3 French scaleups who strategically decided not to enter the US market to use as comparables (i.e. Payfit, Alan, Doctolib).