8 Habits for a Successful Pre-Seed Fundraising

In my short career as an entrepreneur, I have done several fundraising rounds, for my different startups, and for their different stages. I have done a few pre-seed rounds, one seed round, and one Series A. I have also raised money for my Search Fund.

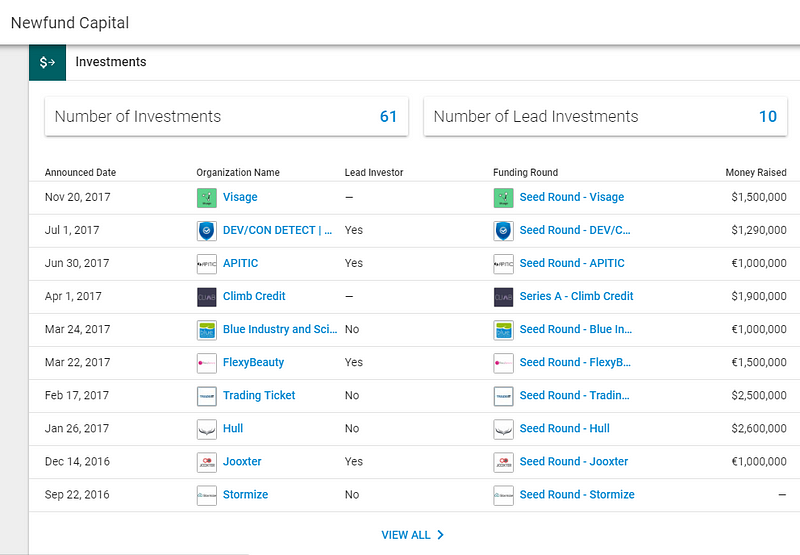

I am now on the other side of the ecosystem, working as an investor for Newfund Capital, one of France’s leading VC funds. I meet entrepreneurs daily with the hope of helping them achieve success.

Two weeks ago, I gave a brief 15 mins speech at L’Ecole 42 on “how to fundraise” for a Pre-Seed round. It was my first time giving a speech in front of a crowd of 100+ people, quite an exciting albeit nervous experience for a first time. Instead of giving some opaque speech about fundraising, I figured giving 8 concrete advices would be more pertinent to future (or current) entrepreneurs.

Assuming you have a project, a solid powerpoint, and actionable events once you receive money, here they are:

1. Be organized and create a smart list of VCs/BAs

Do your research (use Google and Crunchbase), and write down a list of 20 to 30 VCs/BAs that may be a good fit for your startup. Look at which rounds they specialize in, where they invest, how much they invest on average.

Also whether you are raising $100k, $200k, or $400k, I recommend you force yourself to split it in several blocks of $20k, $50k, or $100k. During my pre-seed round, we raised $120k which we split in $20ks and $10k. We forced ourselves to sell 4 blocks of $20k, and two of $10k. One of the investors who purchased a small $10k block later became our largest shareholder in our consecutive rounds. It happened that his cousin was starting a VC fund at the same time and loved what we were doing.

2. Email these VCs/BAs directly, don’t wait for an intro!

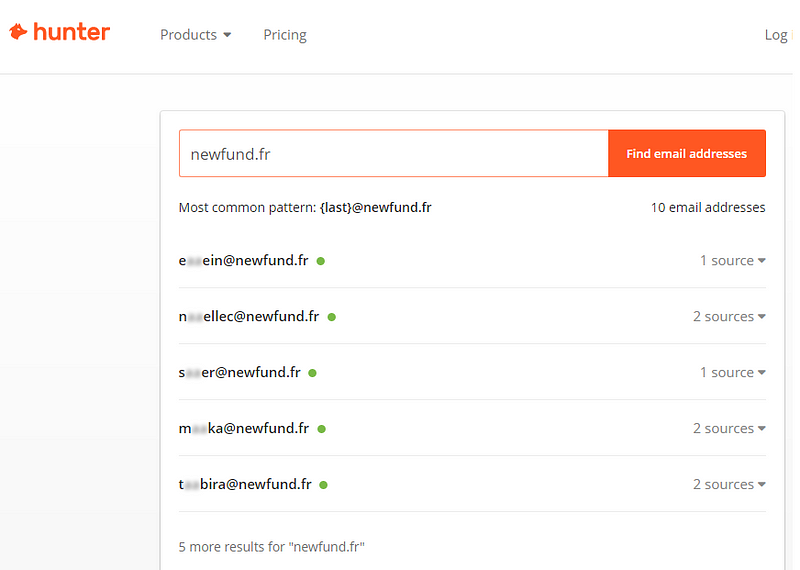

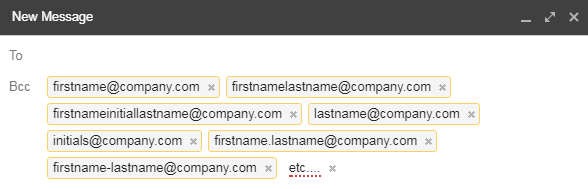

Now that you have your list, it’s time to reach out to them. With hunter.io (Tactic 1), or the classic bcc move (tactic 2), you have access to almost everyone’s email.

Tactic 1:

Tactic 2:

Don’t wait for a friend’s referral to email the VCs/BAs. Do it yourself! Be straightforward when you email them, letting them know you are fundraising and are wondering if they may be interested. Send them a teaser, not necessarily your full deck.

3. Be smart with your emails!

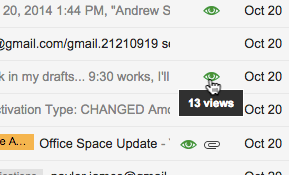

No need to overdo it, but I recommend you install Streak right now! Streak allows you to see if someone has opened your email, when she/he has opened it, and from where. This will allow you to see who is really interested and who is not, to avoid harassing your contacts, and overall be more strategic. [Disclaimer: I am NOT a paid sponsor— I just love their product]

There is no easier way for a VC to say no that if you reach him/her at the wrong moment and saying no to you is one less deal to analyze in the dozens he/she may receive weekly.

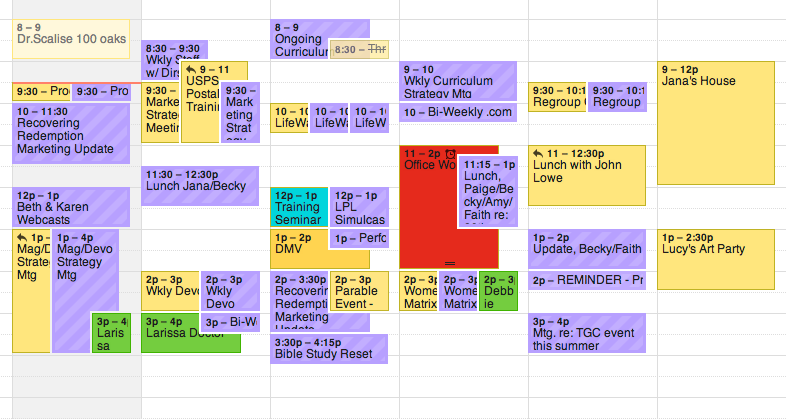

Streak also allows you to schedule your email. This should be obvious but don’t send fundraising emails at 8pm! Write them at 8pm and schedule them for 8am. No excuse for your contact to forget answering you.

4. Do not say sorry for being here!

Being an entrepreneur is tough. It’s a very lonely job, as surrounded as you may be. It’s a job only other entrepreneurs can understand, and that’s why entrepreneurs often surround themselves with other entrepreneurs. Never say sorry for being here. By that, I mean, email, call, knock on doors, fight, and make people regret not giving you money. Don’t be revengeful, but success mostly depends on your willingness to weather the downs of the entrepreneur’s rollercoaster.

5. Space your meetings

Once you have emailed your list of contacts, I bet you at least 80% will want to meet you (that is if you did some research and targeted the right people — don’t email a VC specialized in Series A & B for your pre-seed round). Try to meet the people you think you don’t have the best fit early on, and the one you really want in your cap table later on. Chances are you will have a great fit with some in a few early meetings, but for the most part, you’ll get used to the questions, refine your pitch, and get ready for the tricky questions with the VCs/BAs you really care for. [With that being said, I hope I am one of the last VCs you will meet during your road show ;-)]

6. Don’t bullshit VCs, they are specialists at smelling it!

Don’t tell a VC, during or after a meeting, that you wish they would invest in you because you had a great fit, blah blah blah. Bullshit! It makes you look desperate… Depending on the VCs, they see anywhere from 500 to 5,000 “deals” annually, and almost ALL VCs/BAs only invest in 1% of them. Therefore be different! And make sure they understand your vision, not trying to impose on you their vision.

In my last startup, I had two VCs in the capital with opposite management strategies. One looked for growth, the other one for profitability. While they helped us tremendously, I should have only chosen the one that agreed most with my vision and yet that could still challenge me.

As an investor, I see two to four entrepreneurs daily, and most tell me there was a good fit, even when the meeting didn’t go well. Instead look for other ways to connect with the VCs/BAs, whether they invested in a friend’s company, or you both went to the same high school. It goes without saying, don’t be obvious.

7. Know your value!

The end of your meeting with a VC/BA, and chances are you will have a conversation VCs like to call the “equity story”. Be ready for the following questions:

a. How much have you raised so far?

b. How much have you invested?

c. What’s your pre-money valuation?

d. Why does that valuation make sense?

e. What is the equity split among the co-founders?

Know your valuation and be convincing. Never give up more than 15% at a pre-seed round. Target to give 5% to 15%, and if anyone wants more, spend more time finding someone else! If the discussion goes into how you can argue for that value, just answer it’s a % equity decision. There is no revenue or EBITDA multiple to argue for, since you are still at the powerpoint level. Lastly, make sure your valuation isn’t too high so that you have a clear upround for your next round.

8. Next steps?

Finally, before you leave the meeting, ask for next steps! I cannot stress this enough. As an investor, I have so many meetings where the discussion goes really well, and the entrepreneur just leaves, afraid of asking for our next steps.

Ask the investor what his/her investment process is, what can help the investor’s potential partnership with you. Again, don’t be pushy, but force them to speak out and to commit to at least analyzing the opportunity you are bringing them. You will also leave the meeting with a better sense of what you have accomplished and where you are headed to with that particular VC/BA. Below are select next steps interested VCs may ask you:

a. Send the pdf version of your deck.

b. Send the xlsx version of your BP. I recommend you send them the BP NOT hardcoded. Sending them the hardcoded summarized version is just giving them one more chance to say NO.

c. Second meeting at your offices to dig deeper on certain key issues.

Once you fundraise, best of luck! There is no turning back, you are now a certified-funded entrepreneur! You will have the experience of a life time! And never forget Churchill: “If you are going through hell, keep going!”.

If you have more questions on the process, feel free to email me at augustin@newfund.fr. If you are fundraising, I would also be happy to meet you at our Paris or Mountain View offices.

Newfund Capital: Newfund is an early stage VC fund with offices in Paris and Mountain View. We invest anywhere from $300k to $6M, with an average ticket of $1M. The fund has €200M in AUM, and a portfolio of 59 startups, of which 20 are in the US. We are multi-specialist, product-driven, and entrepreneur-focused.

Your feedback is priceless, feel free to ping us at vera@newfundcap.com.